Lot of Important Astro events are happening between 26-28 Jan, Finance Nifty is near its 200 DMA and formed an inside bar, Break of 19878 can lead to quick fall towards 19683, BUlls will get chance above 20255 in between 19897-20255 it will remain rangebound with voaltile bias till budget day.

- Bayer Rule 6: The price is in bottom when Mars was in 16 degrees 35 minutes of some sign and plus 30 degrees.

- Mercury Conjunct Mars

- SUN Square Jupiter

- Mercury Square North Node

- Venus Extreme Declination

- Uranus Direct

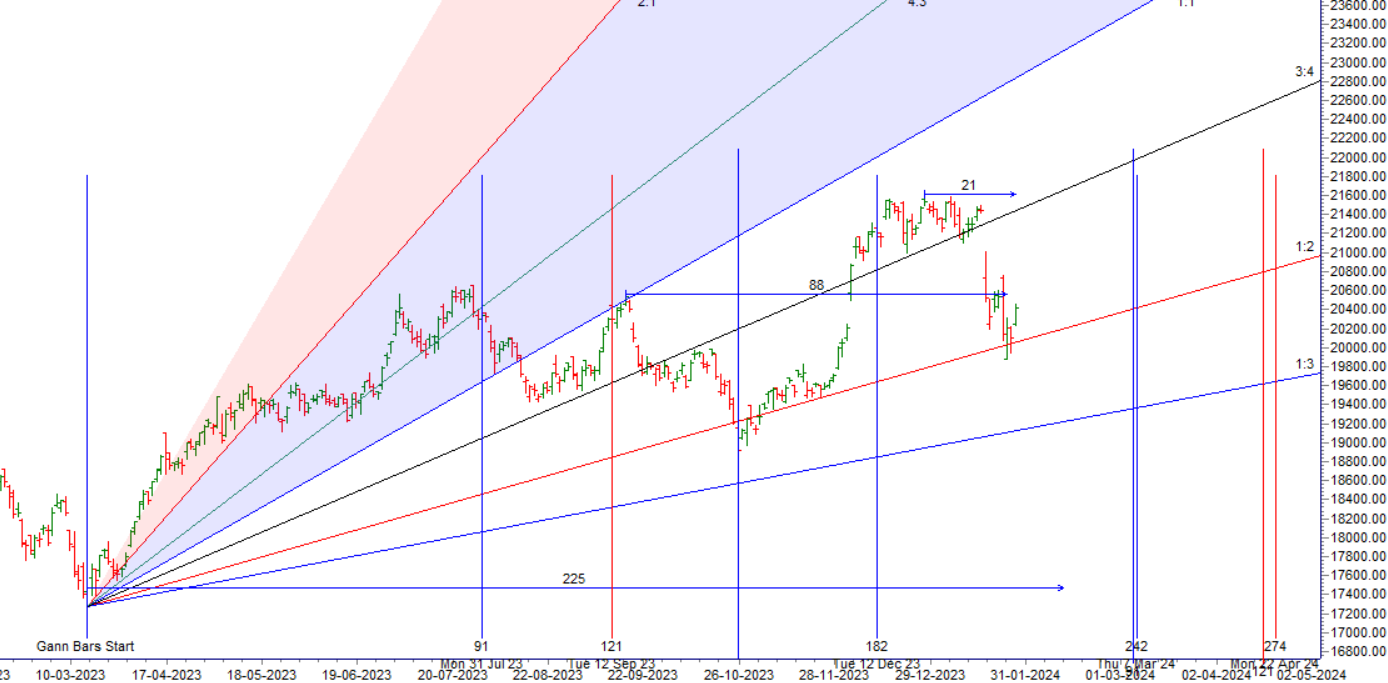

Finance Nifty bounced from its gann angle and we saw the imapct of gann and astro cycle as discussed in below video. Till BUlls are holding 20250 price can see rally towards 20600/20797. Bears are having chance below 20250 only.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 20449 for a move towards 20520/20591/20662. Bears will get active below 20378 for a move towards 20306/20235.

Traders may watch out for potential intraday reversals at 10:01,11:29,12:00,2:35 How to Find and Trade Intraday Reversal Times

Finance Nifty Feb Futures Open Interest Volume stood at 63520 with liquidation of 6920 contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Finance Nifty Decline Ratio at 16:03

Finance Nifty Rollover Cost is @20669 closed below it.

Finance Nifty Gann Annual Trend Change Level : 19882 — Bounced from 19882

Finance Nifty has bounced from its 100 DMA @20263.

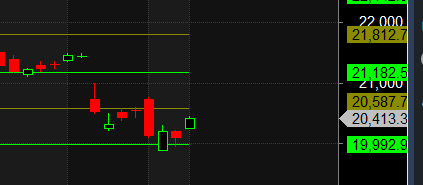

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 21182-20587-19992 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 20450 strike, followed by the 20500 strike. On the put side, the 20300 strike has the highest OI, followed by the 20200 strike. This indicates that market participants anticipate Finance Nifty to stay within the 20300-20500 range.

The Finance Nifty options chain shows that the maximum pain point is at 20450 and the put-call ratio (PCR) is at 0.78. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

If you want to be a successful trader going through a loss making period You need to learn the art of losing.. If you condition your mind to lose without anxiety without emotional attachment and without desire to get even.. Things will start turning around for you.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 20272 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 20488, Which Acts As An Intraday Trend Change Level.

Finance Nifty Expiry Range

Upper End of Expiry : 20580

Lower End of Expiry : 20245

Finance Nifty Intraday Trading Levels

Buy Above 20470 Tgt 20500, 20528 and 20555 ( Finance Nifty Spot Levels)

Sell Below 20420 Tgt 20390, 20365 and 20343 ( Finance Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.