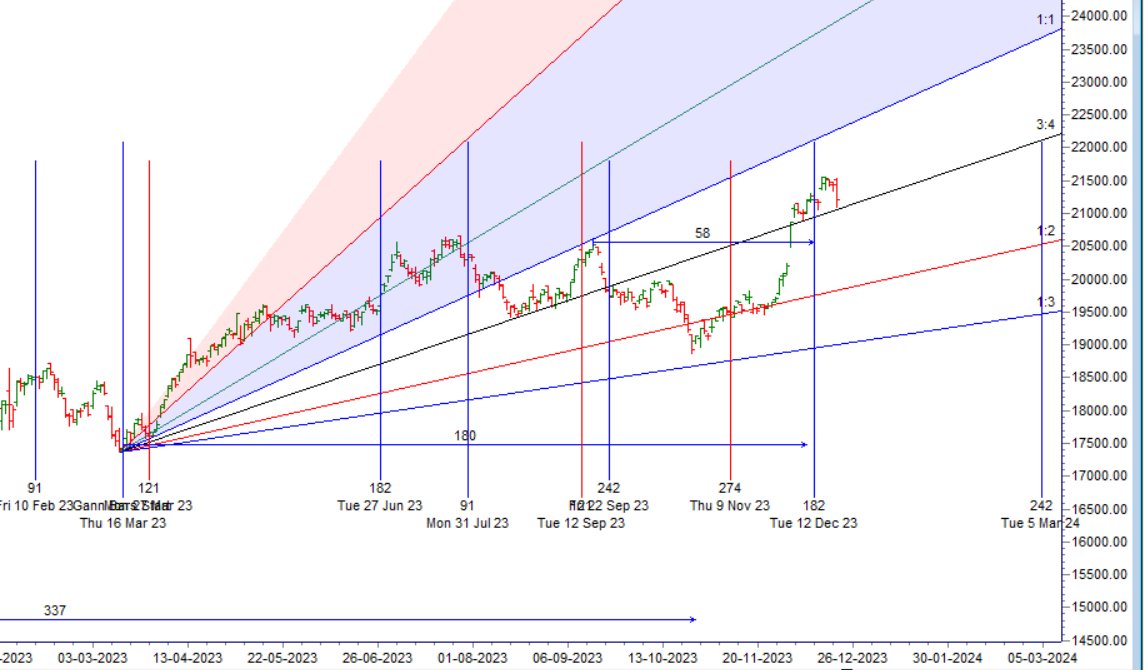

We have seen a volatile day yesterday and today will be another volatile day as we are seeing confluence of Gann and Astro cycle as discussed in below video. For Gann Students Observe price behaviour between 19-Dec to 21 Dec in 2021/2022.

Finance Nifty experienced a notable pullback, influenced by the convergence of both Gann and astro cycles, as discussed in the last video. Today marks the Winter Solstice, another significant Gann Natural date, potentially leading to heightened volatility. With Mars forming a YOD with Uranus and Venus opposing Uranus, the first 15 minutes’ high and low will serve as crucial guides for the day. It’s fascinating to witness the potent market reversals when Gann and Astro cycles align. Incorporating time cycle studies provides an additional edge, showcasing the intricate interplay between technical analysis and astrological influences. Traders are advised to exercise caution in navigating the potential fluctuations on this dynamic day.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 21258 for a move towards 21332/21405. Bears will get active below 21111 for a move towards 21038/20963.

Traders may watch out for potential intraday reversals at 9:46,11:12,12:53,1:39,2:39 How to Find and Trade Intraday Reversal Times

Finance Nifty Nov Futures Open Interest Volume stood at 67120 with liquidation of 7840 contracts. Additionally, the idecrease in Cost of Carry implies that there was a covering of LONG positions today.

Finance Nifty Advance Decline Ratio at 1:19, Finance Nifty Rollover Cost is @20700 closed above it.

Bank Nifty Gann Monthly Trend Change Level : 20655

Finance Nifty has closed above its 20/50/100/200 DMA, TIll 21350 is held bulls have upper hand and trend is Buy on Dips. — Bears broke 21350 till its not captured it become sell on rise market.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 20587-21182-21812 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 21100 strike, followed by the 21200 strike. On the put side, the 21000 strike has the highest OI, followed by the 20900 strike. This indicates that market participants anticipate Finance Nifty to stay within the 21000-21300 range.

The Finance Nifty options chain shows that the maximum pain point is at 21450 and the put-call ratio (PCR) is at 0.85. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Traders always aim for holy grail in trading. They think that will be the answer for all their hardships they are facing because of trading financial markets.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 21187 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 21387 , Which Acts As An Intraday Trend Change Level.

Finance Nifty Intraday Trading Levels

Buy Above 21212 Tgt 21242, 21275 and 21300 ( Finance Nifty Spot Levels)

Sell Below 21166 Tgt 21333, 21000 and 20950 ( Finance Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.