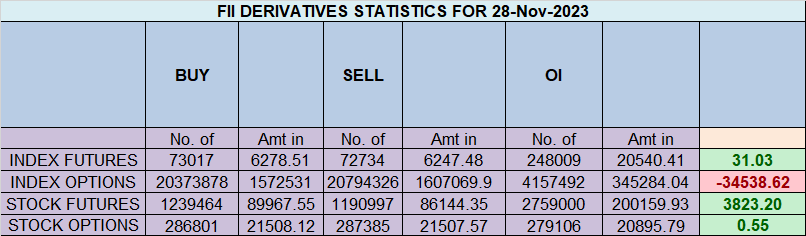

Analysis of FIIs’ behavior in the Nifty Index Futures market shows a Bullish approach as they displayed a preference for LONG positions. On a net basis, FIIs went LONG 441 contracts worth 44 crores, resulting in an increase of 10569 contracts in the Net Open Interest.

Nifty formed a Double top at 19875, Price is facing diffculty in crossing 19875-19881 range as discussed in below video. Today we have Mars on the Move as its changing Sign, Bayer Rule 9: Big changes on market are when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius,also over 24 degrees 14 minutes of Capricorn. and Sun Square Saturn which is important for Indices, Multiple astro Aspect involving Mars which is a Energy Plannet can lead to powerful move. Monday is a trading Holiday so carry overnight positons with Hedge.

NIfty has closed above its Mars and Sun INgress high and also above 16 Nov High of 19875 after 7 trading session. Range of 16 Nov was 19875-19627=248 points. So Bulls can see an Upmove towards 20000/20123. Bears will have chance only when price start trading below 19875 for more than an Hour.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 19832 for a move towards 19902/19972. Bears will get active below 19763 for a move towards 19693/19623/19554.. Waiting for 19972

Traders may watch out for potential intraday reversals at 09:32,10:05, 12:14,2:09 How to Find and Trade Intraday Reversal Times

Nifty Dec Futures Open Interest Volume stood at 0.45 lakh cr , witnessing a addition of 21.5 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Nifty Advance Decline Ratio at 38:12 and Nifty Rollover Cost is @19372 closed below it.

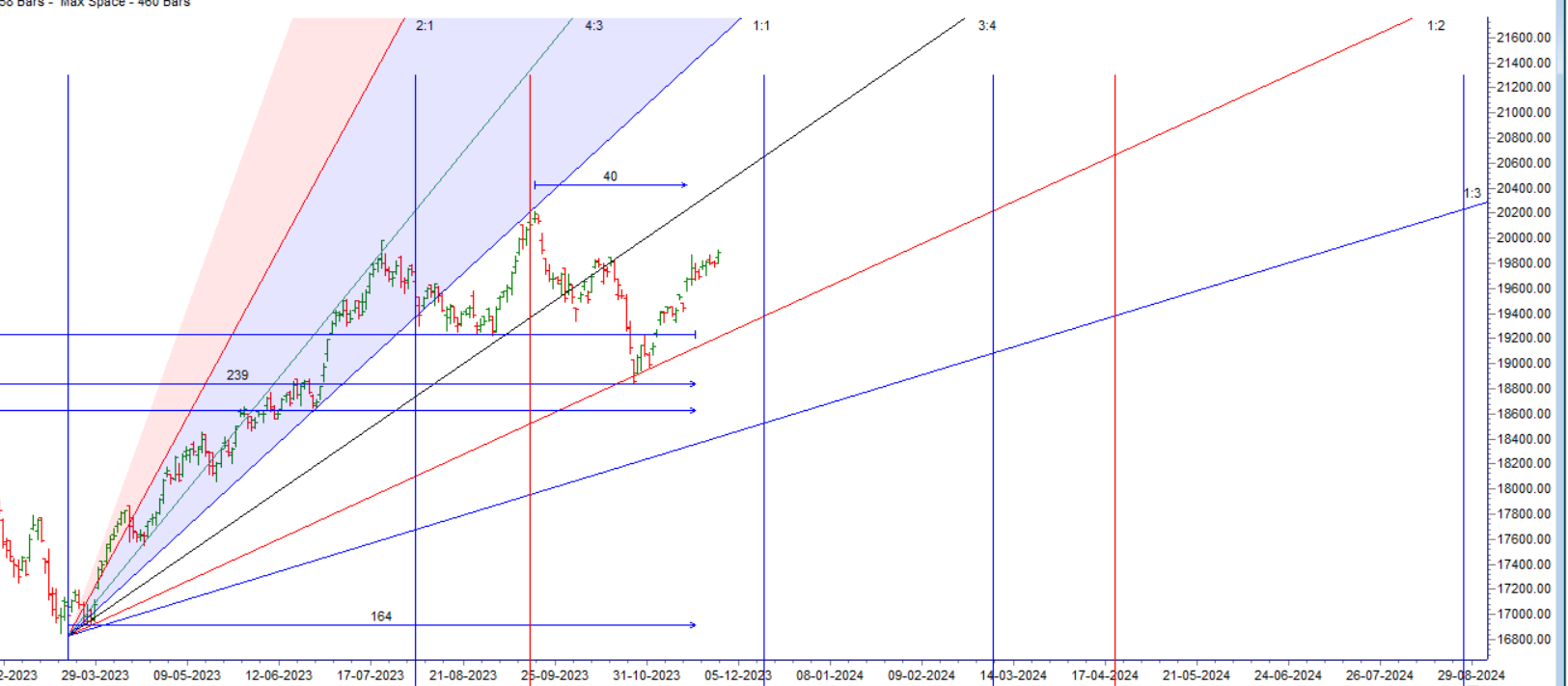

Nifty Gann Monthly Trend Change Level : 19224

Nifty has closed above all short term moving averges Trend is Buy on dips till we are holding above 19875.

Nifty options chain shows that the maximum pain point is at 19950 and the put-call ratio (PCR) is at 0.91. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 20000 strike, followed by 20100 strikes. On the put side, the highest OI is at the 19800 strike, followed by 19700 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 19800-20000 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 783 crores, while Domestic Institutional Investors (DII) bought 1324 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 18890-19452-20014 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

My advice to any new traders is to seek a mentor who will offer you trading skills that will allow you to adapt to any market. What works one month may not work the next. But with fully developed trading skills, you can make the necessary adjustments.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 19514 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19880, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 19985 Tgt 20025, 20055 and 20108 ( Nifty Spot Levels)

Sell Below 19925 Tgt 19900, 18868 and 18830 ( Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.