Finance Nifty formed an Outside Bar after 4 DOJI and another day closed above Saturn Direct High and 1×2 Gann Angle and 50% point of 19427 . Today we have Venus Ingress so Private Bank ie. ICICI/HDFC should be in focus. Watch for first 15 mins High and Low to capture the trend of the day. Today is the 9 day of rise from the 26 Oct bottom. 9 is important number as per gann so be ready for a volatile move.

Finance Nifty did an open High today 19574 formed an Inside Bar on Venus Ingress as discussed in below video, “Bayer Rule 14: VENUS MOVEMENTS IN GEOCENTRIC LONGITUDE USING A UNIT OF 1*9’13”” and Moon at 0 Declination are 2 important events happeing tommrow. Also price is near Gann Angle and 09 is Gann date as shown below chart. As Both Astro and Gann Date are Confluencing again we should see a trending move in next 2 days.

Finance Nifty Trade Plan for Positional Trade ,Bulls will get active above 19562 for a move towards 19632/19702. Bears will get active below 19425 for a move towards 19356/19250.

Traders may watch out for potential intraday reversals at 9:20,11:53,1:20,2:09 How to Find and Trade Intraday Reversal Times

Finance Nifty Nov Futures Open Interest Volume stood at 58520 with addition of 6520 contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Finance Nifty Advance Decline Ratio at 08:11, Finance Nifty Rollover Cost is @19275 closed above it

Finance Nifty has closed above its 20 DMA @19512, Holding 19500 can see rally towards 19666/19729. Break of 19420 quick fall towards 19250

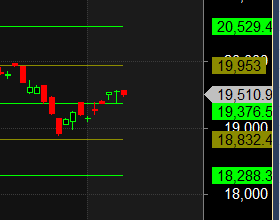

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 18832-19376-19953 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has taken closed above 19376

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 19550 strike, followed by the 19650 strike. On the put side, the 19450 strike has the highest OI, followed by the 19400 strike. This indicates that market participants anticipate Finance Nifty to stay within the 19400-19600 range.

The Finance Nifty options chain shows that the maximum pain point is at 19500 and the put-call ratio (PCR) is at 0.88 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

“Years of practice at the game, of constant study, of always remembering, enable the trader to act on the instant when the unexpected happens as well as when the expected comes to pass.”

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 19415. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19587, Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels for Finance Nifty

Buy Above 19525 Tgt 19555, 19585 and 19620 ( Finance Nifty Spot Levels)

Sell Below 19500 Tgt 19485, 19450 and 19423 (Finance Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.