Gann’s Hidden Gems: Yearly Trend Change Levels” refers to a trading strategy and concept popularized by W.D. Gann, a legendary trader who lived in the early 20th century. Gann was known for his innovative and unique approach to trading, which included the use of mathematical and geometric principles. The “Yearly Trend Change Levels” are part of his broader trading methodology.

Gann’s approach to trading is somewhat esoteric and can be challenging to grasp fully. However, here’s a simplified explanation of the concept:

- Yearly Time Frame: Gann believed that the yearly time frame was essential for understanding longer-term trends in financial markets. He often emphasized the significance of observing price movements over an entire year to identify major trend changes.

- Trend Change Levels: Gann suggested that markets tend to change direction at specific price levels or angles. These levels are often derived from geometrical and mathematical calculations. For yearly trends, Gann believed that certain price levels or angles could act as significant turning points for the market.

- Geometric Analysis: Gann employed various geometric tools, such as Gann angles and squares, to identify potential trend change levels. These tools involved drawing angles and lines on price charts to predict future support and resistance levels.

- Application: Traders who follow Gann’s methodology would use his calculations to identify critical price levels on yearly charts. When price approaches these levels, they would look for confirmation signals, such as candlestick patterns or other technical indicators, to determine whether a trend reversal or significant market move is likely.

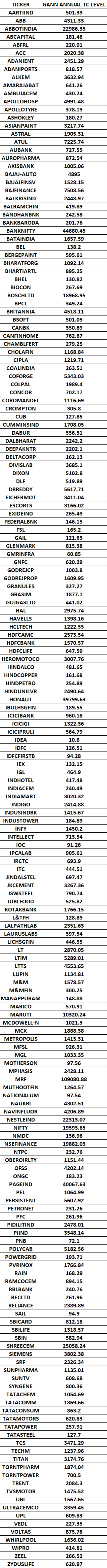

Levels Link

https://docs.google.com/spreadsheets/d/1r4jOfCXSQbed8UFPMtf8cPUVQ019xQzU6gwvdkDGz_g/edit?usp=sharing

It’s essential to note that Gann’s trading concepts are highly subjective and open to interpretation. Different traders may apply his principles in various ways, and not all traders find success with his methods.

Here are some key points to keep in mind when considering Gann’s Hidden Gems:

- Gann’s approach requires a deep understanding of his techniques, which can be complex and challenging to master.

- Gann’s Hidden Gems should be used as part of a broader trading strategy and not in isolation.

- Historical price data is often used to apply Gann’s concepts, so it’s important to have access to accurate and reliable historical market data.

- Many modern traders and analysts consider Gann’s methods as one of several tools in their trading toolkit, rather than relying solely on his techniques.

Ultimately, whether you choose to incorporate Gann’s Hidden Gems or any other trading methodology into your strategy, it’s important to thoroughly research and test it in a simulated environment before risking real capital. Trading always involves risks, and a well-thought-out and tested strategy can help manage those risks effectively.