Finance Nifty has formed an NR7 pattern, range was lowest in last 7 days and price is also near its 20 DMA. Today we also have “RULE NO. 38 MERCURY LATITUDE HELIOCENTRIC Some mighty fine tops and bottoms are produced when Mercury in this motion passes the above mentioned degrees” , FIn Nifty will open gap up so watch out for first 15 mins HIgh and LOw to capture trend for the day.

Finance Nifty opened with a gap up and saw brutal selling in the last 1 hour, filling all the gap and forming an Outside Bar Candle with Bayer’s Rule 38 showing its effect. Today, we have a very strong aspect between Jupiter and Saturn, along with a SuperMoon (Supermoon, a rare occurrence where the moon appears larger and brighter in the sky, last time it happened on 31 Jan 2018 and next it will happen in 2037.)as discussed in the video below. So, get ready for another explosive move today. Since today is the monthly closing and Finance Nifty is closing below last month’s low of 19,893, it suggests that the 4-month rally is coming to a halt. Bears need a break below 19,500 and bulls above 19,900 for a trending move to occur; otherwise, the sideways movement will continue. Hopefully, in the next 2 days, we will break out of this range and start a big bang move in the month of September. Also, watch for the 3 PM candle today for an intraday move to capture.

Finance Nifty Trade Plan based on Outside Bar ,Bulls will get active above 19729 for a move towards 19800/19864/19950. Bears will get active below 19666 for a move towards 19600/19558/19478

Traders may watch out for potential intraday reversals at 10:31,11:19,12:28,1:52,2:10,2:55 How to Find and Trade Intraday Reversal Times

Finance Nifty Sep Futures Open Interest Volume stood at 41680 with liquidation of 28040 contracts. Additionally, the increase in Cost of Carry implies that there was a covering of LONG positions today.

Finance Nifty Advance Decline Ratio at 02:18, Finance Nifty Rollover Cost is @20638

Finance Nifty reacted from its 20 SMA and now heading towards 100 DMA @ 19597.

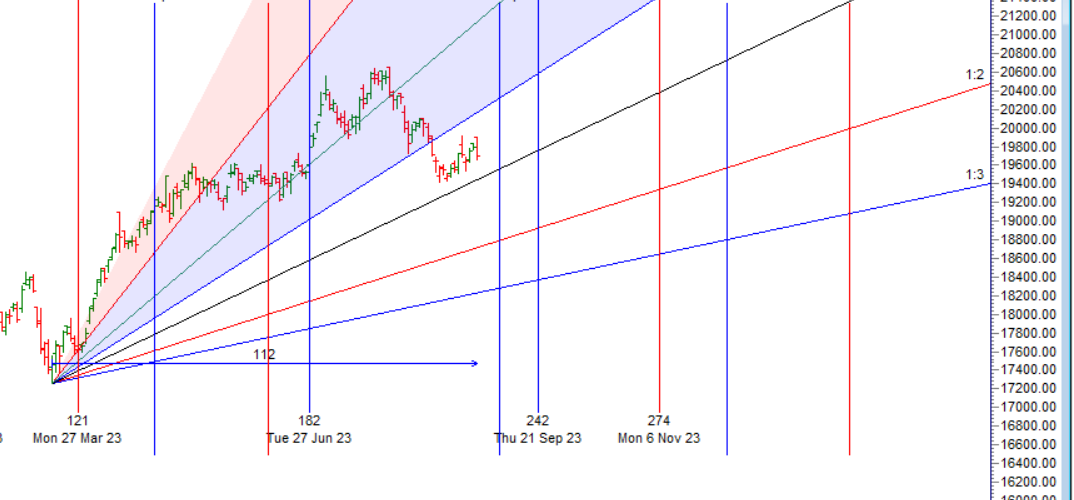

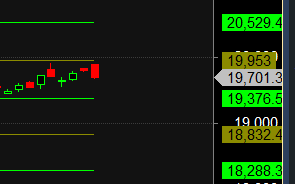

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 20529-19953-19376 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has reacted from 19953

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 19800 strike, followed by the 19900 strike. On the put side, the 19700 strike has the highest OI, followed by the 19600 strike. This indicates that market participants anticipate Finance Nifty to stay within the 19600-19900 range.

The Finance Nifty options chain shows that the maximum pain point is at 19700 and the put-call ratio (PCR) is at 0.92 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Usually people will add to a loser more easily than to a winner. There is an urge to deny our mistakes by adding to losers.

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 19937 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 19927 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels for Finance Nifty

Buy Above 19729 Tgt 19760 , 19799 and 19854 (Fin Nifty Spot Levels)

Sell Below 19666 Tgt 19633, 19600 and 19555 (Fin Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.