Finance Nifty continue to trade in range after ICICI and KOtak Bank results. Price is forming lower low lower high and yesterday being Venus Retrogarade so today we can have explosive expiry. FOMC Intrerst Rate Decision will come tommrow evening and today we saw a good recovery in Finance Nifty from lower levels, For trending move to come price needs to close below 20471 or above 20611 which are Jupiter Aspect High and low on closing basis. In Between Sideways Action will continue.

Finance Nifty Trade Plan Based on Saturn Retrograde Bulls will get active above 20611 for a move towards 20681/20751/20821. Bears will get active below 20471 for a move towards 20401/20331/20262/20192

Traders may watch out for potential intraday reversals at 9:22,12:40,1:02,2:13 How to Find and Trade Intraday Reversal Times

Finance Nifty June Futures Open Interest Volume stood at 109080 with addition of 53360 contracts. Additionally, the decrease in Cost of Carry implies that there was a addition of LONG positions today.

Finance Nifty Advance Decline Ratio at 9:10

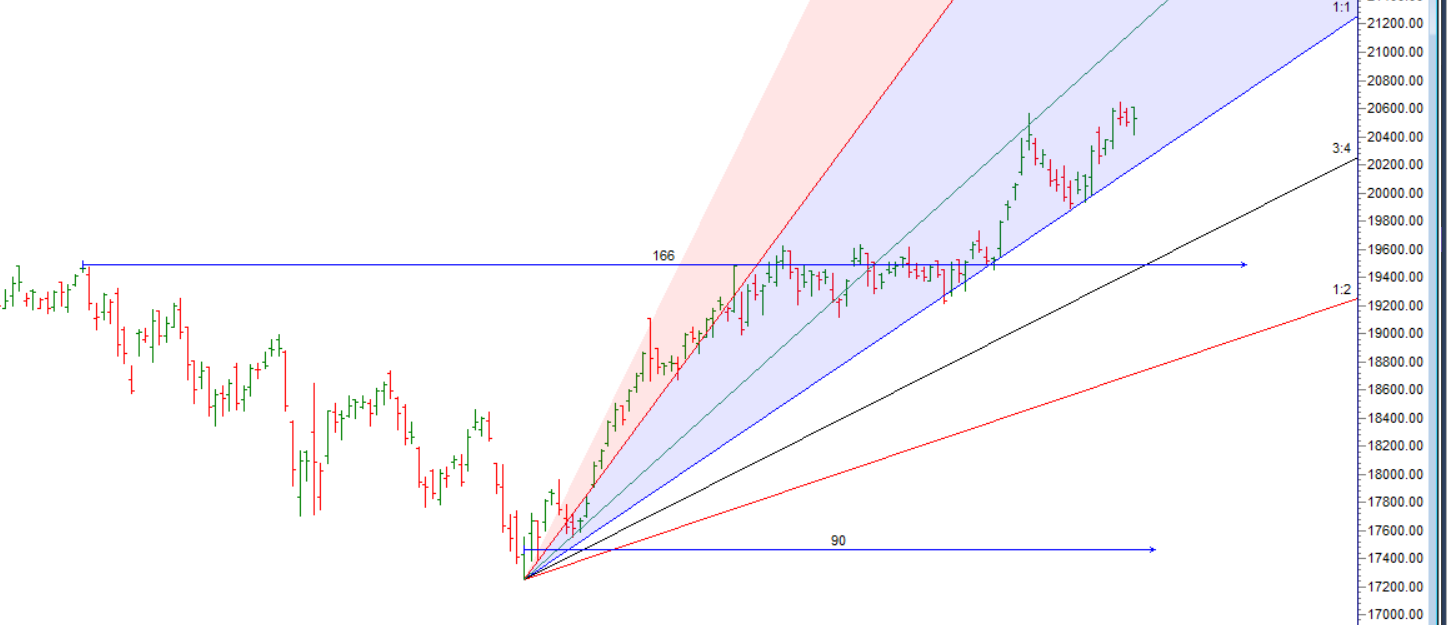

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 20529-19953-19376 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 20529

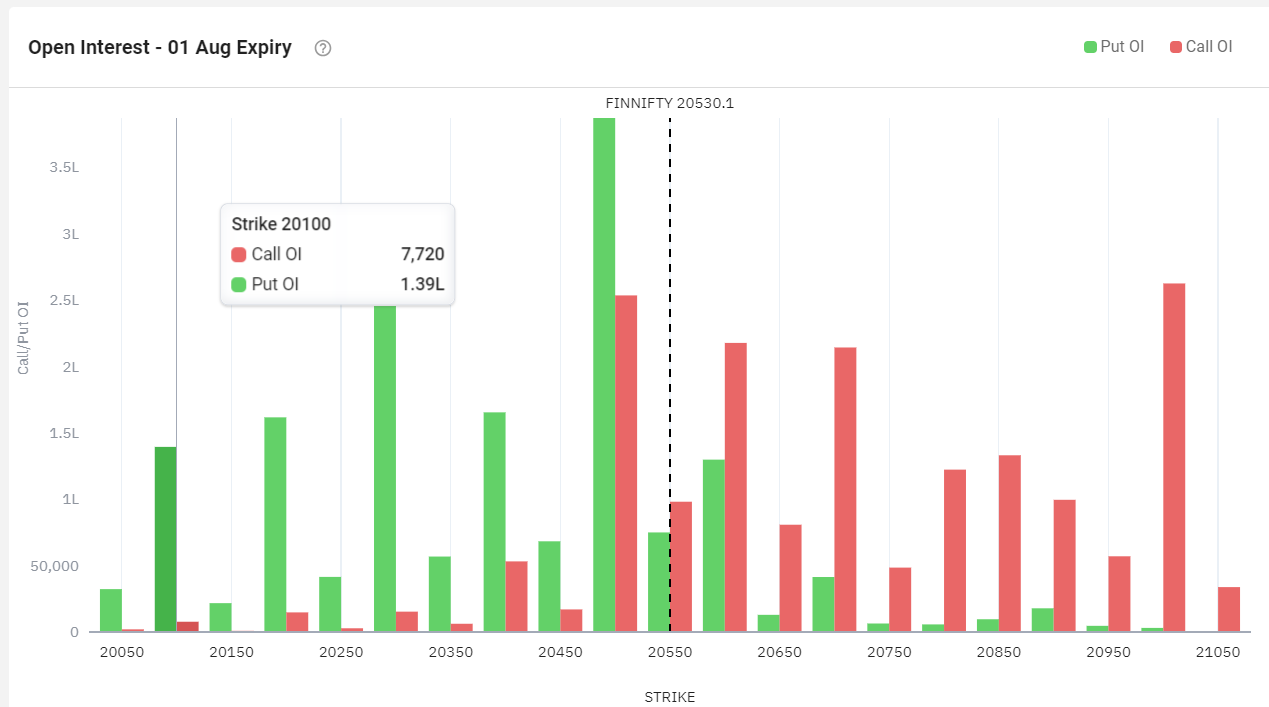

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 20700 strike, followed by the 20600 strike. On the put side, the 20500 strike has the highest OI, followed by the 20400 strike. Total Calls OI is 17.4 Lakh and Total Put OI is 16.26 Lakh This indicates that market participants anticipate Finance Nifty to stay within the 20400-20700 range.

The Finance Nifty options chain shows that the maximum pain point is at 20500 and the put-call ratio (PCR) is at 0.95. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Your goal every day is to improve. Each day is a gift from the market to improve. Work hard. Each day is an opportunity to get better. Focus on the process

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 20246 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 20505, Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels for Finance Nifty

Buy Above 20541 Tgt 20585, 20627 and 20666 (Fin Nifty Spot Levels)

Sell Below 20500 Tgt 20450, 20400 and 20343 (Fin Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.