Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Bank Nifty Index Futures market by Buying 1877 contracts worth 130 crores, resulting in a decrease of 347 contracts in the Net Open Interest.

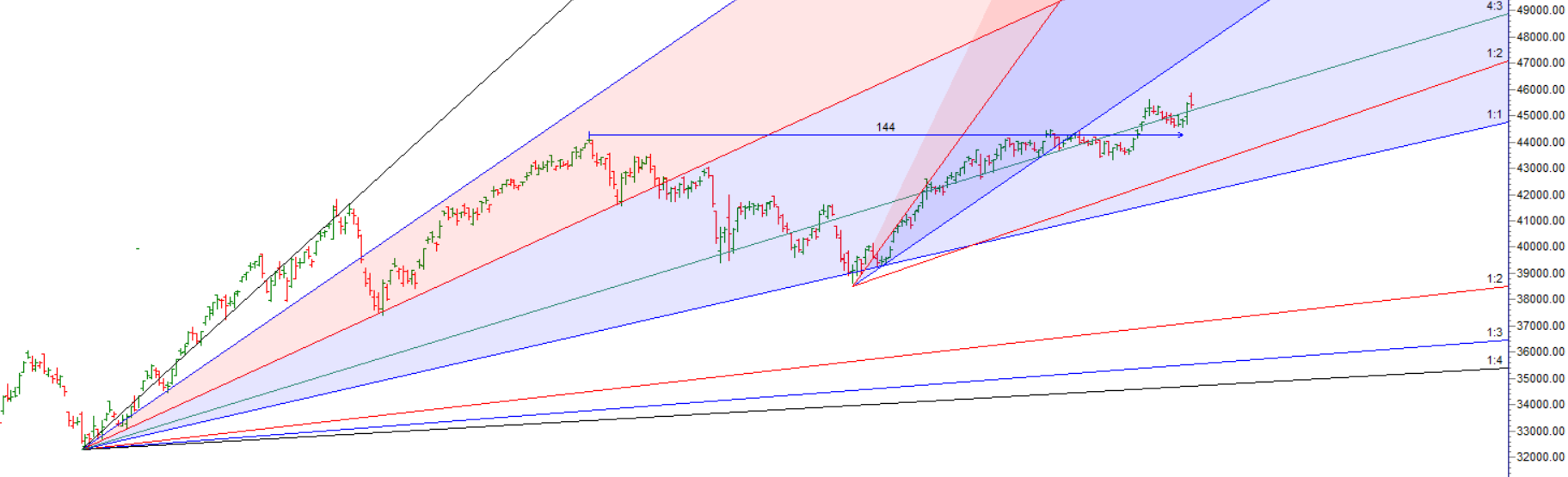

As Discussed in Last Analysis Mercury Square Jupiter Aspect and 144 Bars Gann played a powerful combination, leading to a significant rally in the Bank Nifty. Whenever Gann and Astrology combine, it often indicates a substantial market move. The all-time high of Bank Nifty stands at 45655 , which might prove challenging to surpass. Today’s rise can be attributed to short-covering bounce, and once the short squeeze subsides, the price tends to revert back to the mean.

The movement of the Lunar Node to Aries signifies a potential decline in business activity below normal levels, so it is crucial to observe management commentary to understand future earnings prospects.

Yesterday, the Bank Nifty experienced significant volatility, which can be attributed to the impact of the North Node. The price faced difficulty in closing above4 North Node Ingress High of 45556, The volatile movement may continue today as well. Today, we have two important short-term astrological events: Venus Square Mercury HELIO and Pluto, along with Earth being at its minimum distance. These events involving Mercury, Venus, and the outer planet Pluto indicate the potential for volatile moves in the Bank Nifty. As long as the price remains below 45556, the bears may have a slight advantage.

Bank Nifty Trade Plan Based Bulls will get active above 45477 for a move towards 45691/45905. Bears will get active below 45263 for a move towards 45048/44834/44620

Traders may watch out for potential intraday reversals at 9:36,10:43,1:082,2:39 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 20.7 lakh, liquidation of 3.5 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a liquidation of LONG positions today.

Bank Nifty Advance Decline Ratio at 3:9 and Bank Nifty Rollover Cost is @44037 and Rollover is at 72.6%

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 45923

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 45700 strike, followed by the 46000 strike. On the put side, the 45300 strike has the highest OI, followed by the 45000 strike. This indicates that market participants anticipate Bank Nifty to stay within the 45300-45900 range.

The Bank Nifty options chain shows that the maximum pain point is at 45400 and the put-call ratio (PCR) is at 1.02. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Confidence is trait which a trader needs to develop to make money on consistent basis. Trading success is achieved when trader is able to execute trades confidently and overcoming trading emotions.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45029 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 45140 , Which Acts As An Intraday Trend Change Level.