W. D. GANN was a renowned trader and market analyst who developed various techniques to predict market movements. His methods were a blend of mathematical calculations, pattern recognition, and an understanding of natural cycles. While many of GANN’s techniques are widely known, his use of solar dates remains shrouded in mystery and intrigue.

Gann’s Forecasting Methods

William Delbert Gann is considered as one of the most successful stock and commodity traders ever lived. W. D. Gann’s market forecasting methods are based on geometry, astronomy, astrology, and ancient mathematics.

Through his methods, he found that on certain dates the market trend changes. Gann says that on these days the Sun comes at 15 degrees or 90 degrees with earth. He considered these positions very significantly, and that the market sentiments tend to change on these dates. Sometimes Gann dates are exact and at times it is a day or two ahead or behind.

He used geometrical divisions of the solar year (solar degrees of longitude and calendar days) to ascertain turning points in financial markets. Days pertaining to 45, 90, 135, 180, 225, 270, and 315 solar degrees from Vernal Equinox (= 0 degrees Aries) are what he called Natural Trading Days.

The Concept of Solar Dates

Solar dates refer to specific points in time that align with celestial events such as equinoxes, solstices, and other significant astronomical occurrences. GANN believed that these cosmic events exerted a profound influence on market trends, making them ideal for forecasting future price movements. By identifying and analyzing solar dates, GANN aimed to gain insights into the cyclical nature of markets. GANN’s fascination with celestial events stemmed from his belief in the interconnectedness of the universe. He observed that various financial markets exhibited cyclical patterns that correlated with astronomical phenomena. GANN theorized that the movements of planets and stars influenced human behavior, leading to recurring market cycles.During his lifetime, GANN successfully made numerous accurate predictions using solar dates. His ability to forecast major market turning points, significant highs and lows, and trend reversals garnered attention and admiration from fellow traders. GANN’s precise timing based on solar dates added an extra dimension to his trading strategies, contributing to his legendary status in the financial world.

Static Solar Dates

According to Gann, there are two types of Solar dates: Static and Dynamic. He always said the year begins on March 21st, which is the first static date and not January 1st. He also stated that this was a very important seasonal time.

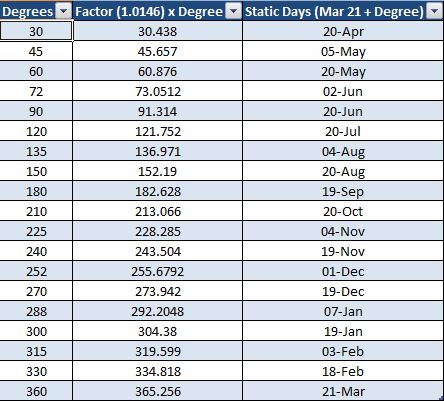

Here is how we get the static dates:

– Average days in a calendar year are 365.256

– Divide it by 360 (degrees in a circle) i.e 365.256 / 360 = 1.0146. Therefore, 1degree = 1.0146 days.

– Static degrees where a trend reversal or a significant impact on financial markets may occur as per Gann are 30, 45, 60, 72, 90, 120, 135, 150, 180, 210, 225, 240, 252, 270, 288, 300, 315, 330 and 360 degrees.

– Multiply these degrees with 1.0146 and add that to the first static date i.e. Mar 21 to get all the accurate static days.

Generally on these dates the market is expected to make major highs, lows, tops and bottoms.

While GANN’s solar dates offer valuable insights, they are not foolproof. Challenges and limitations exist when incorporating solar date analysis into trading strategies. Factors such as market volatility, unexpected events, and the human element can impact the accuracy of predictions. Traders must be aware of these limitations and employ risk management practices to mitigate potential losses.To maximize the effectiveness of solar date predictions, traders often combine them with other technical analysis tools. Moving averages, trend lines, oscillators, and Fibonacci retracements are commonly used in conjunction with solar dates to validate potential market movements. This holistic approach helps traders make well-informed decisions and increases the probability of successful trades.

You need to be alert on these days or a day or two before or after the static solar day and react to the market based on the price action or whatever setup you generally trade with. Other Gann techniques like Gann Swing, Square of 9 degrees etc may yield better results.

W. D. GANN’s solar dates continue to captivate traders and researchers alike. Their historical significance and potential impact on financial markets cannot be denied. By understanding the underlying concepts, analyzing historical data, and leveraging modern tools, traders can explore the secrets of GANN’s solar dates and potentially unlock profitable trading opportunities.