Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Bank Nifty Index Futures market by Buying 852 contracts worth 101 crores, resulting in a decrease of 222 contracts in the Net Open Interest.

As Discussed in Last Analysis

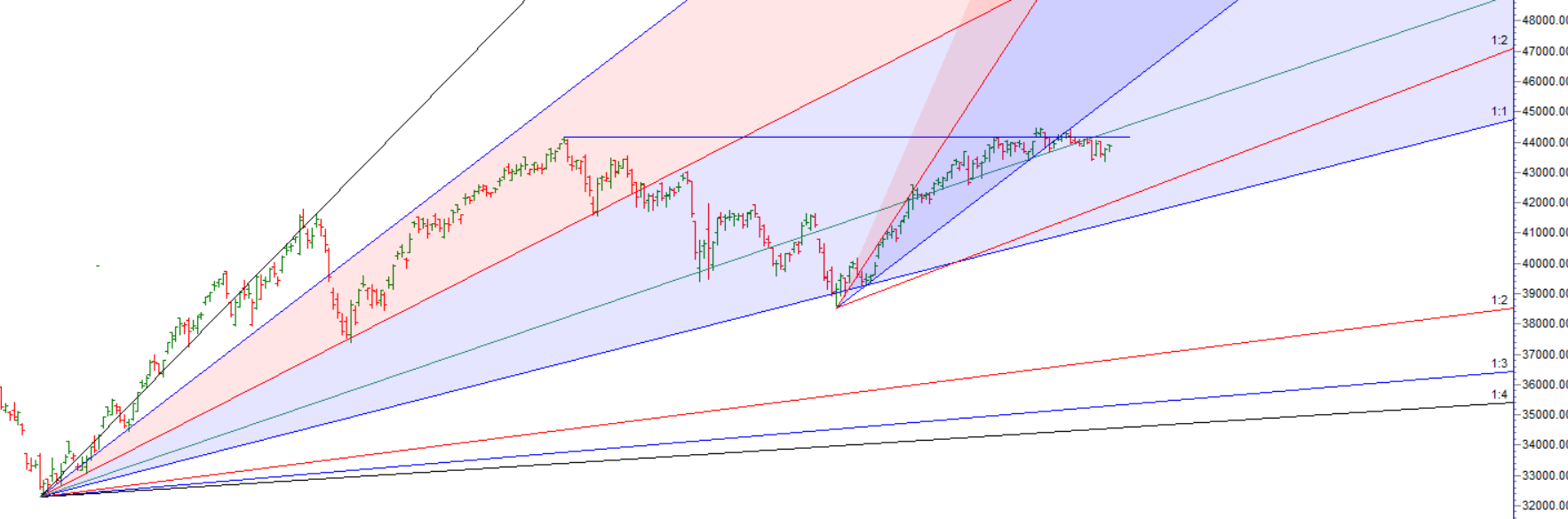

Summer Solstice will come tomorrow Evening, Gann has specifically talked a lot above this Solar Dates, Price is still below Satrun Retrograde High, For short term bearishness to come price need to close below 18600, till its not breached any fall or correction will get recovered like today.

Today is the Summer Solstice. Watch the first 15 minutes for the high and low prices to capture the market trend. The Bank Nifty price is squeezed between the 20 and 50 SMA (Simple Moving Averages) and formed an NR7 pattern today.

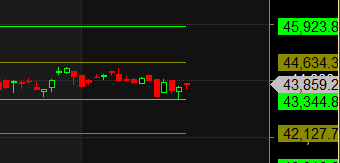

Bank Nifty Trade Plan Based Bulls will get active above 43950 for a move towards 44070/44194/44318/4442. Bears will get active below 43698 for a move towards 43575/43451/43327/43203

Traders may watch out for potential intraday reversals at 09:20,10:43,11:48,2:38 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 22.6 lakh, liquidtion of 0.39 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 5:7 and Bank Nifty Rollover Cost is @43908 and Rollover is at 72.2%

Major Resistance for Bank Nifty us at 43974 which is 20 SMA,Major Support at 43419 @ 50 SMA.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 42127-43344-44634 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 44000 strike, followed by the 44200 strike. On the put side, the 43700 strike has the highest OI, followed by the 43500 strike. This indicates that market participants anticipate Bank Nifty to stay within the 43500-44000 range.

The Bank Nifty options chain shows that the maximum pain point is at 43800 and the put-call ratio (PCR) is at 1.04. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Fundamental of Trading : 1. Proper preparation 2. Hard work 3. Patience 4. A detailed plan before every trade 5. Discipline 6. Trade Journal 7. Replaying important trades

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 44088. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 43908 , Which Acts As An Intraday Trend Change Level.