Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 2579 contracts worth 240 crores, resulting in a increase of 8815 contracts in the Net Open Interest. FIIs bought 6145 long contracts and added 1166 short contracts, indicating a preference for adding NEW LONG positions .With a Net FII Long Short ratio of 0.90 , FIIs utilized the market fall to enter Long positions and exit short positions in NIFTY Futures.

As Discussed in Last Analysis We saw a decent fall in Nifty today again we have “RULE NO. 38 MERCURY LATITUDE HELIOCENTRIC Some mighty fine tops and bottoms are produced when Mercury in this motion passes the above mentioned degrees”, New Moon on Saturday and SATRUN Retrograde on SUnday so carry overnight position with Hedge

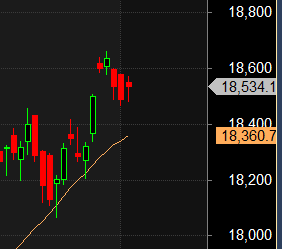

Nifty made an inside bar with multiple astro event happening on Weekend as disccused above, Also Venus is having ingress on Monday , Venus has a good impact on market and we will open gap up will be sustain gap is question. 18610 is level to watch on upside unable to cross Bears can move Index towards 20 SMA.

Trade Plan as per Inside Bar Formed Bulls will get active above 18621 for a move towards 18669/18716/18764. Bears will get active below 18430 for a move towards 18383/18335/18287.

Traders may watch out for potential intraday reversals at 9:15,9:53,10:58,12:09,1:37 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 0.90 lakh, witnessing a addition of 2.4 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Nifty Advance Decline Ratio at 35:15 and Nifty Rollover Cost is @18407 and Rollover is at 66.8%.

Major Support for Nifty us at 18360 @ 20 SMA

Nifty options chain shows that the maximum pain point is at 18500 and the put-call ratio (PCR) is at 1.02. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18600 strike, followed by 18700 strikes. On the put side, the highest OI is at the 18400 strike, followed by 18300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18400-18600 levels.

According To Todays Data, Retailers Have bought 105 K Call Option Contracts And 111 K Call Option Contracts Were Shorted by them. Additionally, They bought 99 K Put Option Contracts And 104 K Shorted Put Option Contracts were covered by them, Indicating A BULLISH Outlook.

In Contrast, Foreign Institutional Investors (FIIs) bought 293 K Call Option Contracts And 188 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 204 K Put Option Contracts And 166 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To A BEARISH Bias.

In the cash segment, Foreign Institutional Investors (FII) Sold 658 crores, while Domestic Institutional Investors (DII) bought 581 crores.

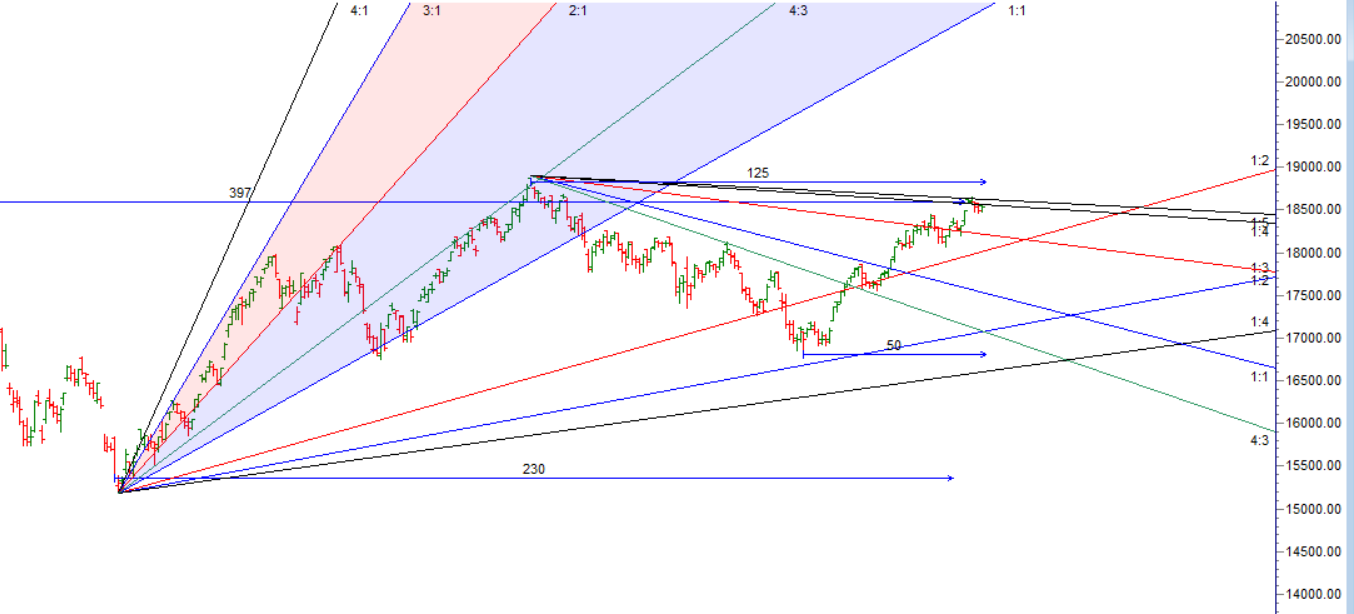

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 17744-18272-18800 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has close above 18272

Don’t overtrade. It’s tempting to trade frequently, but this can lead to losses. It’s better to trade less and focus on making high-quality trades.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18586 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18623 , Which Acts As An Intraday Trend Change Level.