Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Buying 17641 contracts worth 1643 crores, resulting in a decrease of 13033 contracts in the Net Open Interest. FIIs sold 18148 long contracts and added 3604 short contracts, indicating a preference for adding NEW LONG positions .With a Net FII Long Short ratio of 1.17 , FIIs utilized the market fall to exit Long positions and enter short positions in NIFTY Futures.

As Discussed in Last Analysis Nifty continued with its upmove, we have monthly close tommrow Bulls would like to close above 18666 and Bears below 18500. FII have been relentlessly Buying in equities. They have net Bought approximately 24 K crore so far this month and DII sold just 777 cores in May and Nifty is up just 3% for the month.

Nifty has shown Island Reversal Pattern today Tommrow we have important astro dates as discussed in below video

Bayer Rule 30: The trend changes when Venus in declination passes the extreme declination of the Sun.

Mars YOD Saturn and Jupiter Conjunct North Node Aspect

First 15 Mins High and Low will guide for the day.

Trade Plan based on Astro Date, For Swing Traders Bulls need to move above 18641 for a move towards 18701/18761 . Bears will get active below 18581 for a move towards 18521/18461. Below 18500 Price can move towards 18423/18363

Traders may watch out for potential intraday reversals at 9:15,10:24,12:49,1:53 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 0.93 lakh, witnessing a liquidation of 6.2 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 18:32 and Nifty Rollover Cost is @18407 and Rollover is at 66.8%.

According To Todays Data, Retailers Have bought 127 K Call Option Contracts And 111 K Call Option Contracts Were Shorted by them. Additionally, They sold 565 K Put Option Contracts And 216 K Shorted Put Option Contracts were covered by them, Indicating A BULLISH Outlook.

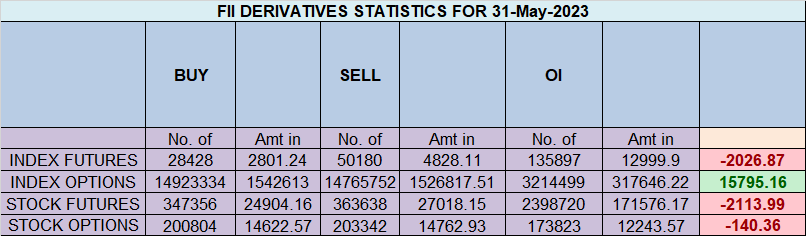

In Contrast, Foreign Institutional Investors (FIIs) bought 161 K Call Option Contracts And 157 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 158 K Put Option Contracts And 5.1 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To A BEARISH Bias.

Nifty options chain shows that the maximum pain point is at 18500 and the put-call ratio (PCR) is at 1.03. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18600 strike, followed by 18700 strikes. On the put side, the highest OI is at the 18400 strike, followed by 18300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18400-18600 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 3405 crores, while Domestic Institutional Investors (DII) sold 2528 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 17744-18272-18800 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has close above 18272

Don’t chase losses. If you make a bad trade, don’t try to make it up by trading more. This will only lead to more losses.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18574 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18619 , Which Acts As An Intraday Trend Change Level.

Good analysis