Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 7335 contracts worth 676 crores, resulting in a increase of 8163 contracts in the Net Open Interest. FIIs bought 6217 long contracts and added 4601 short contracts, indicating a preference for adding new Buying positions .With a Net FII Long Short ratio of 0.92 , FIIs utilized the market fall to enter Long positions and enter short positions in NIFTY Futures.

Price has shows a decent bounce from 1×2 Gann anle, Today being double ingress astro date today high and low will guide for the week. Trade Plan as shown below

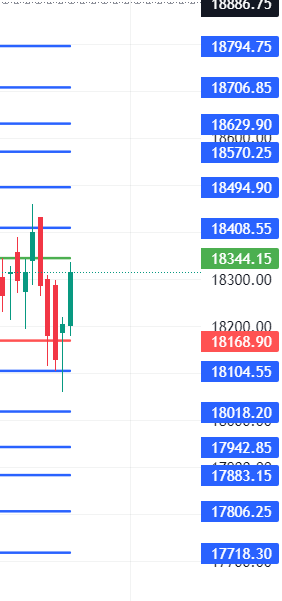

For Swing Traders Bulls need to move above 18344 for a move towards 18408/18494/18570. Bears will get active below 18168 for a move towards 18104/18018/17942.

Traders may watch out for potential intraday reversals at 9:15,10:40,11:22,1:23,2:28 How to Find and Trade Intraday Reversal Times

Nifty May Futures Open Interest Volume stood at 0.96 lakh, witnessing a liquidation of 8.8 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a closure of SHORT positions today.

According To Todays Data, Retailers Have bought 102 K Call Option Contracts And 85 K Call Option Contracts Were Shorted by them. Additionally, They bought 120 K Put Option Contracts And 114 K Put Option Contracts were Shorted by them, Indicating A BULLISH Outlook.

In Contrast, Foreign Institutional Investors (FIIs) bought 214 K Call Option Contracts And 221 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs bought 124 K Put Option Contracts And 148 K Shorted Put Option Contracts were covered by them, Suggesting They Have Turned To A BULLISH Bias.

Nifty Advance Decline Ratio at 34:16 and Nifty Rollover Cost is @17885 and Rollover is at 58.7 %.

Nifty options chain shows that the maximum pain point is at 18250 and the put-call ratio (PCR) is at 0.98 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18300 strike, followed by 18400 strikes. On the put side, the highest OI is at the 18200 strike, followed by 18100 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18200-18400 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 922 crores, while Domestic Institutional Investors (DII) bought 604 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 17744-18272-18800 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has close above 18272

Remember, the first item on the agenda for a beginner is to learn how to trade, not to make money. Once you’ve learned to trade, money will follow.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18240. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18302, Which Acts As An Intraday Trend Change Level.