Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Bank Nifty Index Futures market by Selling 2227 contracts worth 239 crores, resulting in a decrease of 4913 contracts in the Net Open Interest.

We saw a big reversal in Bank Nifty tommrow we have

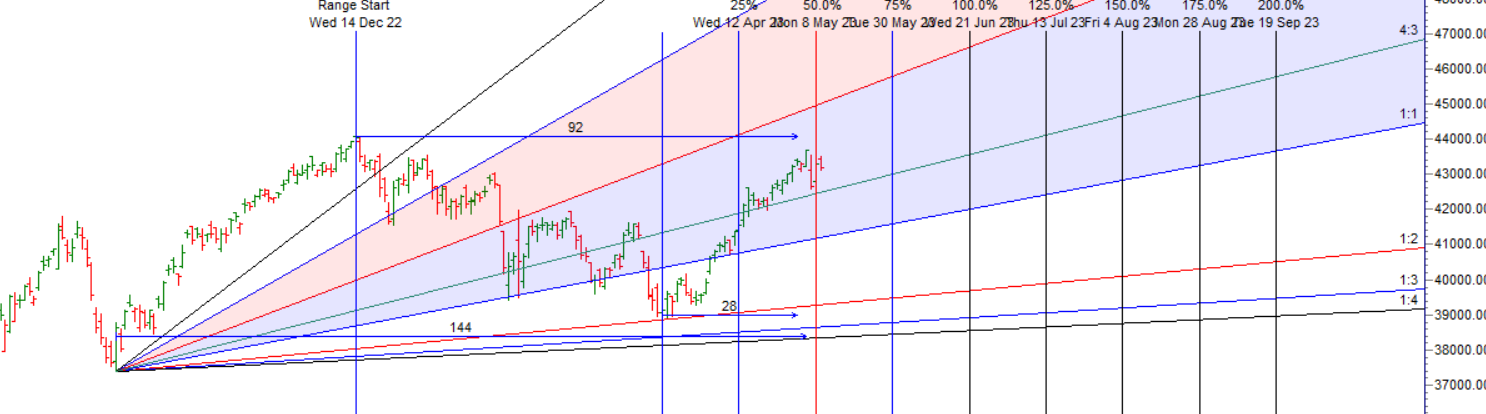

“Bayer Rule 15: VENUS HELIOCENTRIC LATITUDE AT EXTREME AND LEAST SPEEDS FOR MAJOR MOVES Imp Rule” and SUN Conjunct Uranus Aspect so time to be a cautious as we have gann date also today as shown in below gann chart.

Uranus is a plannet of Stock Market.

US CPI data will come today evening Hedge your overnight positions, As per Neural we might see a gap down open.

Bank Nifty again got rejected from 43500 level as we have multiple Astro date yesterday so high and low will be very important. trade plan we have discuused as below.

As per Multiple Astro Date Yesterday below is the Plan based on Intraday Ratio Indicator

Bulls need to move above 43554 for a move towards 43758/43962/44151. Bears will get active below 43103 for a move towards 42899/42695/42470.

Traders may watch out for potential intraday reversals at 9:17,10:02,10:57,11:46,2:12 How to Find and Trade Intraday Reversal Times

Bank Nifty May Futures Open Interest Volume stood at 22.4 lakh, liquidation of 1.3 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a closeure of Long positions today.

Bank Nifty Advance Decline Ratio at 5:7 and Bank Nifty Rollover Cost is @42773 and Rollover is at 75.8%

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 40789-41967-43216 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is has broken 43216

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 43500 strike, followed by the 44000 strike. On the put side, the 43000 strike has the highest OI, followed by the 42500 strike. This indicates that market participants anticipate Bank Nifty to stay within the 43000-43500 range.

The Bank Nifty options chain shows that the maximum pain point is at 43200 and the put-call ratio (PCR) is at 0.97. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Neurons and synapses in our brain are real destiny and with proper learning and revision, performance is accelerated.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 43094 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 43344, Which Acts As An Intraday Trend Change Level.