Bank Nifty after 18 Days closed below the previous Day Low potentially forming evening star pattern and today being an important astro date. We will see FOMC decision Today FOr any reversal to take place bears need a close below 43038.

An evening star is a stock-price chart pattern used by technical analysts to detect when a trend is about to reverse. It is a bearish candlestick pattern consisting of three candles: a large white candlestick, a small-bodied candle, and a red candle.

Bank Nifty was unable to breach the May 3rd low of 43078 , and once the high of 43355 was crossed, bulls had the upper hand, Bank Nifty is also closed above January HIgh of 43578, Bulls have the upper hand until they can close above 43350. As a trader, our job is to stay with the trend and not anticipate the next move by taking aggressive positions. Bank Nifty has decoupled from the global market, but as a trader, we should remain alert and not get carried away by news. For Reversal Bank Nifty has to close below 20 SMA on 1 Hour chart.

The stock market is a complex system influenced by various factors, including economic indicators, political events, and natural phenomena. One such natural phenomenon is the lunar eclipse, which has been observed to potentially impact the stock market, particularly the Nifty index. A lunar eclipse occurs when the Earth passes between the Sun and the Moon, casting a shadow on the Moon. This celestial event is visible from most parts of the world when the Moon is in the full moon phase.

Historical trends suggest that lunar eclipses can have a short-term impact on the stock market, with a potential dip in performance during and after the eclipse. A study conducted by the National Bureau of Economic Research found that stock market returns were significantly lower during lunar eclipses compared to non-eclipse days

For Swing Traders Break of 43483 can see a rise towards 43591,43698,43805,43912. Bears will get active below 43250 for a move towards 43162,43054,42947,42840. Waiting for Higher target of 43805/43912 till Buls are holding 43484.

Traders may watch out for potential intraday reversals at 10:12,11:28,12:33,2:31 How to Find and Trade Intraday Reversal Times

Bank Nifty May Futures Open Interest Volume stood at 24.6 lakh, addition of 1.5 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of Long positions today.

Bank Nifty Rollover Cost is @42773 and Rollover is at 75.8 %

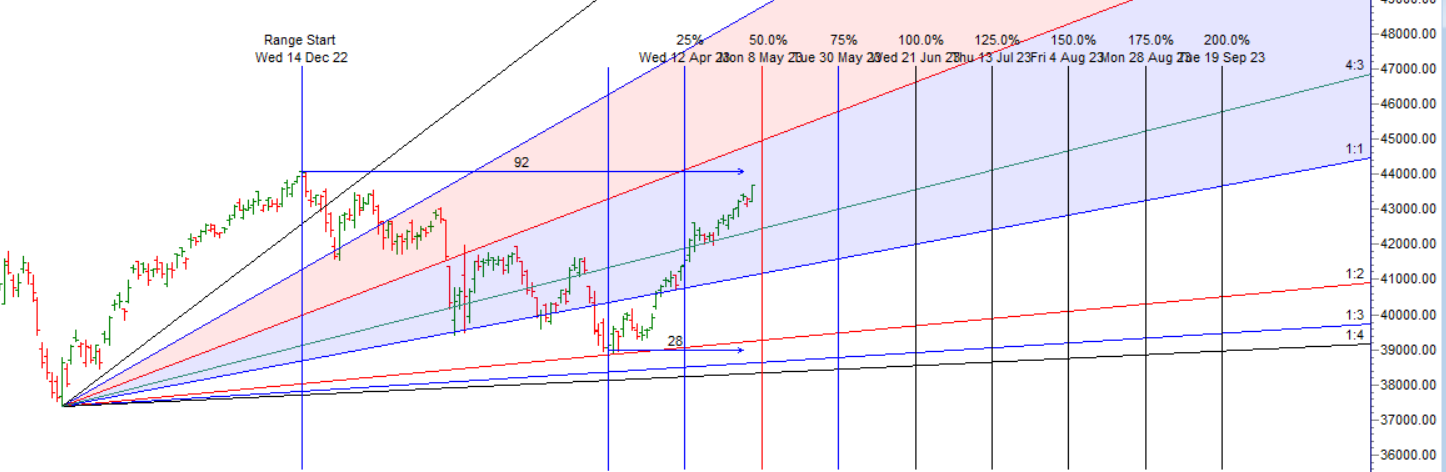

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 40789-41967-43216 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is coming near 43216

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 44000 strike, followed by the 44200 strike. On the put side, the 43500 strike has the highest OI, followed by the 43000 strike. This indicates that market participants anticipate Bank Nifty to stay within the 43000-43500 range.

The Bank Nifty options chain shows that the maximum pain point is at 43600 and the put-call ratio (PCR) is at 1.01 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Perfectionism leads to failure in trading. You must strive for excellence over a sustained period, as opposed to judging each buy or sell signal as perfect. The great traders make losing trades, but they are able to keep the impact of those losses small.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 43099. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 43465 , Which Acts As An Intraday Trend Change Level.