As Discussed In Last Analysis Bank Nifty has closed above 42679 which is 6 month Pivot we have closed above it Longs should keep SL of 42679, Today we have monthly expiry and premium of CE and PE are very low, expect good volatlity in market today as we have “Bayer Rule 33: Moves are when Mars in Geocentric longitude passes over 16 degrees 55 minutes 46 seconds. ” which has Mars plannet in it, Mars bring volatlity in the market so hopefully we will see a good volatilie move today.

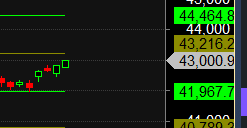

Bank today has completed 90 days from 14 Dec 2022 where it made all time high of 44151, 90 is always considered very important number as per gann. Price continue to make Higher High and today being Monthly close Bulls would like to close above 43108 and bears below 42800. Today we have Multiple Lunar Cycle day so watch out for 3 PM candel for a big move either side. Today being Both Gann and Astro date so we can see a good volatile move.

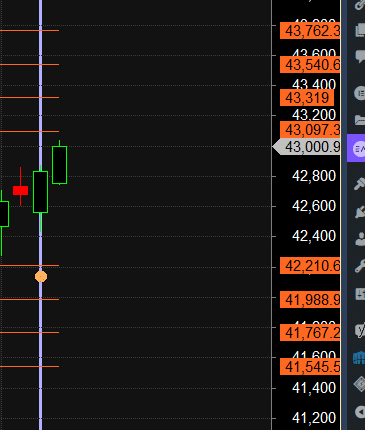

Bank Nifty has formed an Outside Bar pattern today, For Swing Traders Break of 42873 can see a rise towards 42970,43100,43214. Bears will get active below 42593 for a move towards 42496,42366,42252 — Waiting for target of 43100,43214

Traders may watch out for potential intraday reversals at 10:04,10:49,12:44,1:32,2:12,2:56 How to Find and Trade Intraday Reversal Times

Bank Nifty May Futures Open Interest Volume stood at 22 lakh, addition of 6.8 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of Long positions today.

Bank Nifty Rollover Cost is @42773 and Rollover is at 75.8 %

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 40789-41967-43216 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is coming near 43216

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 43200 strike, followed by the 43500 strike. On the put side, the 42800 strike has the highest OI, followed by the 42500 strike. This indicates that market participants anticipate Bank Nifty to stay within the 43000-42500 range.

The Bank Nifty options chain shows that the maximum pain point is at 42800 and the put-call ratio (PCR) is at 0.96. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

The successful speculator bases NO moves on what supposedly will happen, but reacts instead to what does happen.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 43040. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 42897 , Which Acts As An Intraday Trend Change Level.