The stock market has long been a subject of fascination for investors and economists alike. One of the reasons for this is the complex patterns and cycles that govern its movements. Over the years, various theories and methods have been developed to predict these patterns and cycles, with some proving to be more successful than others. One such method that has gained popularity in recent years is the use of the Golden Ratio and time cycles.

The Golden Ratio

The Golden Ratio, also known as the divine proportion, is a mathematical concept that has fascinated mathematicians, artists, and philosophers for centuries. It is represented by the number 1.618 and is believed to be a fundamental principle of the universe.

The Golden Ratio is found in nature, in the proportions of the human body, in art, and in architecture. It is also believed to have significance in the stock market, where it is used to predict market trends and movements.

The Golden Ratio in the Stock Market

The Golden Ratio is closely related to the Fibonacci sequence, which is a series of numbers where each number is the sum of the two preceding ones. The sequence goes 0, 1, 1, 2, 3, 5, 8, 13, 21, and so on. The ratio between any two consecutive numbers in the Fibonacci sequence approaches the Golden Ratio, which is approximately 1.618.

The Golden Ratio is used in the stock market in the form of Fibonacci retracement levels. These levels are used to predict areas of support and resistance in a stock’s price movement. The retracement levels are based on the Fibonacci sequence and are calculated by taking a stock’s high and low points and dividing the vertical distance by the key Fibonacci ratios, which are 23.6%, 38.2%, 50%, 61.8%, and 100%.

Traders use Fibonacci retracement levels to identify potential buy and sell points. When a stock is in an uptrend, traders look for support at the Fibonacci retracement levels, and when a stock is in a downtrend, they look for resistance.

Time Cycles in the Stock Market

Time cycles are another method used to predict stock market movements. Time cycles are based on the premise that history repeats itself, and that the same patterns and cycles occur at regular intervals.

Time cycles are determined by analyzing past market data and identifying recurring patterns and cycles. These cycles can be daily, weekly, monthly, or even yearly. Once the cycles are identified, traders can use them to predict future market movements.

Application of Time Cycles and the Golden Ratio in the Stock Market

The Golden Ratio and time cycles are often used together in the stock market to predict future trends and movements.

The convergence of the Golden Ratio and time cycles in the stock market is a powerful tool for traders and investors. By combining these two methods, traders can identify potential areas of support and resistance, as well as predict future market movements.

One example of the application of the Golden Ratio and time cycles in the stock market is the Dot-com bubble. During the late 1990s, the stock market experienced a boom in technology companies, with many stocks reaching record highs. However, in March 2000, the market crashed, and many of these companies went bankrupt.

Traders who had identified the potential support and resistance levels using the Golden Ratio and time cycles were able to sell their stocks before the crash and avoid significant losses.

Another example is the 2008 financial crisis. Many traders had predicted the crisis by analyzing past market data and identifying the recurring patterns and cycles. By using the Golden Ratio and time cycles, traders were able to identify the potential support and resistance levels, and take advantage of the market movement to make profits.

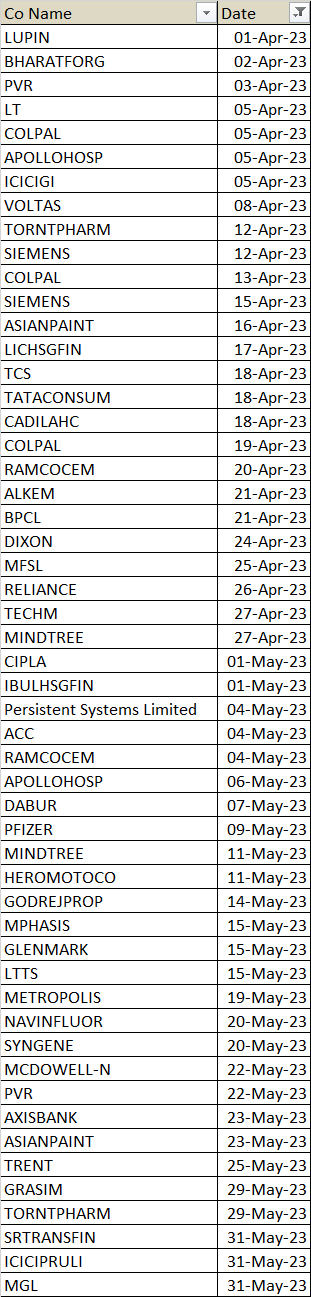

Stocks which are starting new time cycle based on Golden Ratio are shared below for Month of April and May.

In conclusion, the Golden Ratio and time cycles are two powerful tools that can be used to predict stock market movements. By using these methods, traders and investors can identify potential areas of support and resistance, and make informed investment decisions. It is important to note that these methods are not foolproof and should be used in conjunction with other analysis tools.