The National Stock Exchange (NSE) has recently announced a reduction in the lot size of Bank Nifty futures and options contracts. This move has been met with mixed reactions from investors and traders alike. In this article, we will discuss the implications of this change and how it might affect the market.

Hook: The recent announcement by NSE regarding the reduction in the lot size of Bank Nifty futures and options contracts has created a buzz among traders and investors. It has been received with mixed feelings, with some welcoming the move, while others are skeptical. So, what does this mean for the market, and how will it affect you as a trader?

Introduction:

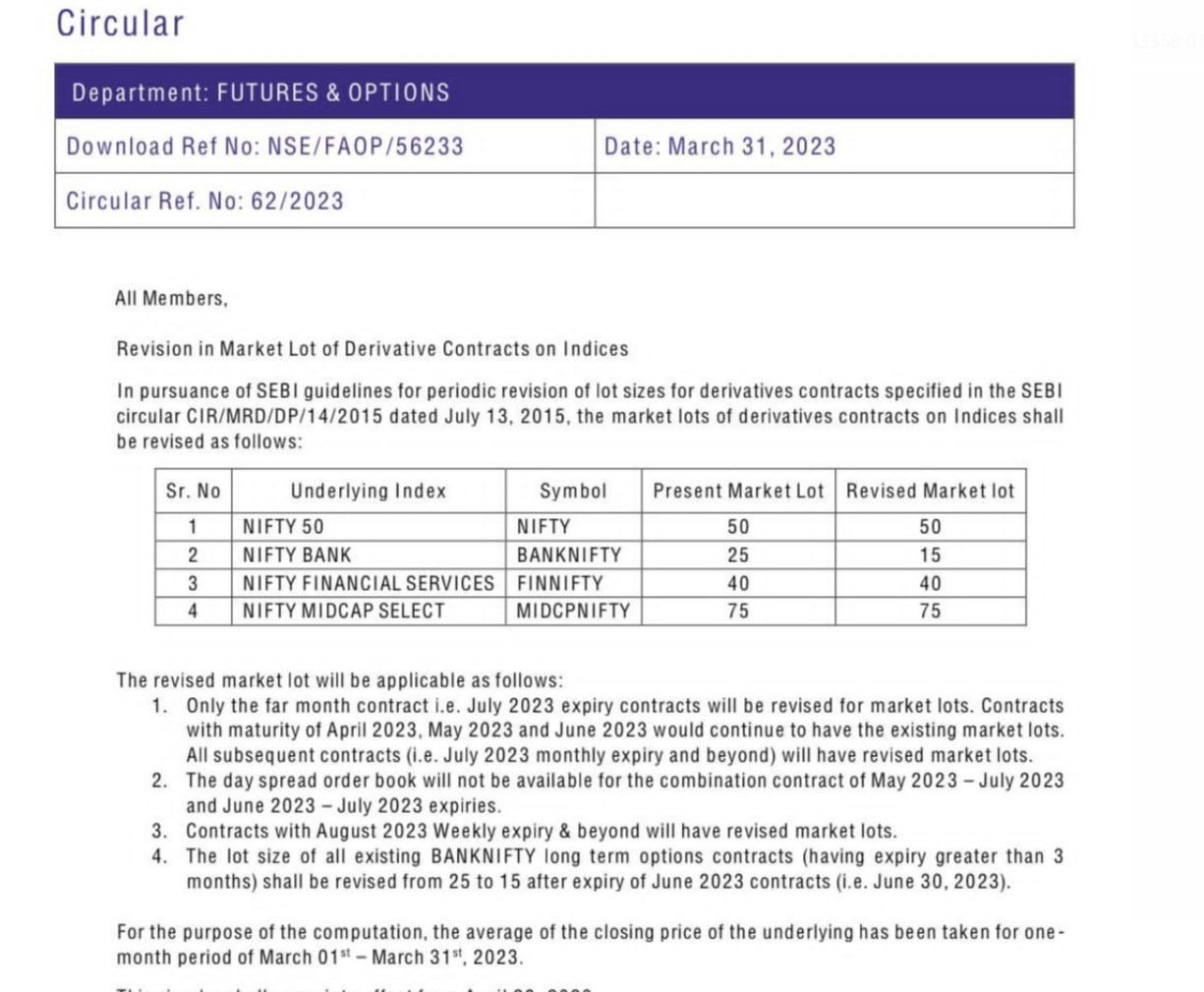

The NSE has reduced the lot size of Bank Nifty futures and options contracts from 25 to 15. The change has taken effect from June 30, 2023. The reason for this change is to make the derivatives market more accessible to retail investors. The smaller lot size will reduce the capital requirement to trade Bank Nifty futures and options contracts, making it easier for retail investors to participate in the market.

However, this move has sparked a debate among investors and traders on how it will affect the liquidity and volatility of the market. Some argue that the reduced lot size will increase liquidity and reduce volatility, while others believe that it will have the opposite effect.

What is Bank Nifty, and How Does it Work?

Bank Nifty is an index of the top 12 banking stocks listed on the NSE. It provides investors with an opportunity to participate in the banking sector’s performance. The index is calculated based on the market capitalization of its constituents. The constituents of Bank Nifty include some of India’s largest banks, such as HDFC Bank, ICICI Bank, State Bank of India, and Kotak Mahindra Bank.

Investors can trade Bank Nifty through futures and options contracts. Futures contracts allow investors to buy or sell Bank Nifty at a predetermined price on a future date, while options contracts give investors the right, but not the obligation, to buy or sell Bank Nifty at a predetermined price on a future date.

The Implications of the Reduced Lot Size

The reduction in the lot size of Bank Nifty futures and options contracts will have several implications for the market.

- Firstly, the reduced lot size will make trading more accessible to retail investors. The smaller lot size will require less capital to trade Bank Nifty futures and options contracts, making it easier for retail investors to participate in the market.

- Secondly, the reduced lot size could increase the trading volume of Bank Nifty futures and options contracts. With a smaller lot size, traders may be more willing to take on larger positions, which could increase the trading volume.

- Thirdly, the reduced lot size could increase the liquidity of the market. With more retail investors participating in the market, there could be a more significant number of buyers and sellers, making it easier to enter and exit trades.

- However, some argue that the reduced lot size could also increase volatility. With more retail investors participating in the market, there could be a higher number of small trades, which could lead to increased volatility.

What Does This Mean for Traders and Investors?

The reduction in the lot size of Bank Nifty futures and options contracts has both positive and negative implications for traders and investors.

For retail investors, the reduced lot size means that trading Bank Nifty futures and options contracts is now more accessible. They will be able to participate in the market with less capital, which could lead to more significant gains in the long run.

For traders, the reduced lot size means that they can take on larger positions with less capital. This could lead to more significant gains in the short term. However, the increased trading volume and potential for higher volatility could also mean increased risk.

Overall, the reduction in the lot size of Bank Nifty futures and options contracts is a positive move for retail investors. It makes trading more accessible and allows for greater participation in the market. However, traders should be cautious and carefully manage their risk when taking on larger positions.

Conclusion:

The reduction in the lot size of Bank Nifty futures and options contracts is a significant development in the derivatives market. It has both positive and negative implications for traders and investors. While the reduced lot size makes trading more accessible, it could also lead to increased volatility and risk. Traders and investors should carefully consider these implications when making their trading decisions.

Be ready to pay more brokerage

What about the cost of trading for lot based brokerages, small margin traders, by lot reduction, the volume is not going to increase, on the contrary, it will get reduced, as I have decided not to do any further trading in BN futures and options, there may be lot of like minded people. With the recent changes of option margin and option trading rules, option trading becomes non-existentattractive.