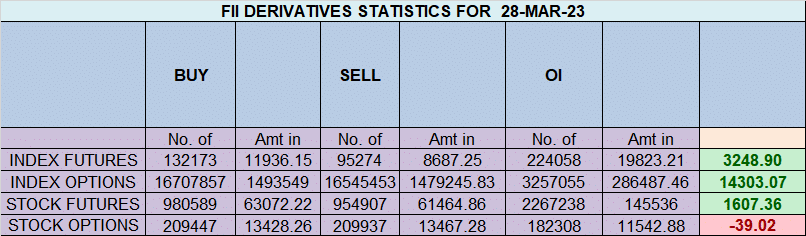

Foreign Institutional Investors (FII) showed a Bullish approach in the Index Futures market by Buying 36899 contracts worth 3248 crores, resulting in a decrease of 25681 contracts in the Net Open Interest. FII’s addec 5609 long contracts and covered 31290 short contracts, indicating a preference for Buying new positions. With a Net FII Long Short ratio of 0.21 FII used the market rise to enter long and exit short positions in Index Futures.

If you’re looking to trade Nifty and want to increase your chances of success, then you need to understand Bayers Rules. While this trading strategy has been around for a long time, many traders still struggle to implement it effectively. In this post, we’ll demystify Bank Nifty Bayers Rules and provide a step-by-step approach to help you master this proven trading strategy.

Bayer Rule 27 states that big tops and major bottoms occur when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes. As of yesterday, Nifty formed Inside Bar and DOJI, and today we have FIN NIFTY expiry with the price still trading above the 1×2 gann angle.

Step-by-Step Approach to Trading Bank Nifty with Bayers Rules

- Step 1: Identify the trend — Trend is Sideways

- Step 2: Determine the entry point– For Long 17100 For Short 16900

- Step 3: Set stop loss and profit target –SL for Long and Short 17008

- Step 4: Monitor the trade and adjust the stop loss and profit target

- Step 5: Exit the trade at the right time

Swing traders can expect a potential move towards 17177, 17263, 17349 if the market trades above 17100. However, if the market falls below 16900 , bears may become more active, leading to a move towards 16832,16746,16656

Traders may watch out for potential intraday reversals at 9:37,10:34,11:22,1:16, 2:56.. How to Find and Trade Intraday Reversal Times

Nifty March Futures Open Interest Volume stood at 0.94 lakh, witnessing a liquidation of 1.16 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closeure of short positions today.

Nifty options chain shows that the maximum pain point is at 17100 and the put-call ratio (PCR) is at 0.82. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. This suggests that Nifty may trade within a range of 16900-17200 levels in the near term

According to Yesterday data, retailers have bought 501927 call option contracts and 581021 shorted Call option contracts were covered . Additionally, they bought 692938 put option contracts and added 635301 shorted put option contracts, indicating a Neutral outlook.

In contrast, foreign institutional investors (FIIs) bought 235635 call option contracts and 103225 shorted call option contracts were covered . On the put side, FIIs bought 144315 put option contracts and shorted 114321 7 put option contracts, suggesting they have turned to a BUllish bias.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 17,100 strike, followed by 17,200 strikes. On the put side, the highest OI is at the 17000 strike, followed by 16900 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 16900-17200 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 890 crores, while Domestic Institutional Investors (DII) bought 1808 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 16825-17326-17826. This means that traders can take a position and potentially ride the move as Nifty moves through these levels.

Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Low made was 16828 now heading towards 17326

I know it may sound strange to many readers, but there is an inverse relationship between analysis and trading results. More analysis or being able to make distinctions in the market’s behaviour will not produce better trading results– Mark Douglas

For Positional Traders, The Nifty Futures’ Trend Change Level is At 17350 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 17042 , Which Acts As An Intraday Trend Change Level.

Superb email sir thanks in tonns