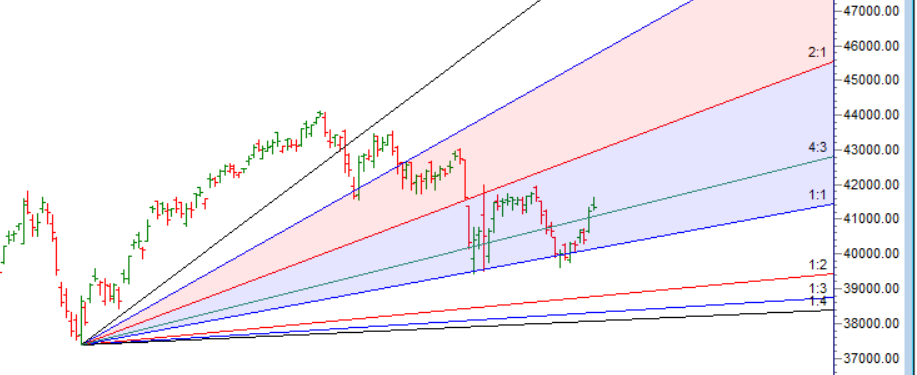

As Discussed in Last Analysis The combination of Gann Price Time Squaring with the Astro Venus Conjuct Jupiter Aspect proved to be a powerful force for the Bulls, leading to a significant rally in Bank Nifty. Watch our discussion of this phenomenon in the below video.

Wishing Everyone Happy Holi

How Holi Can Help Traders Succeed: Lessons in Trading Discipline and Strategy

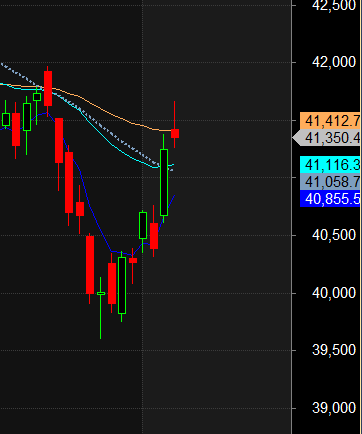

Bank Nifty continued with its Rally after seeing bout of profit booking at end of session but closed just above previous day high. Now as we have two Important Astro Date tommrow so first 15 mins High and Low will guide for the day. 41876-42000 is crucial range for Bank Nifty.

Swing traders can expect a potential move towards 41612, 41814, or 42015 if the Bank Nifty trades above 41411. However, if the Bank Nifty falls below 41209 , bears may become more active, leading to a move towards 41008,40806.

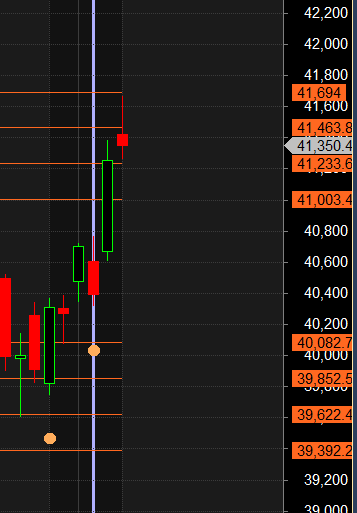

Bank Nifty formed an Outside Bar pattern yestrday, which is a strong indication of a trend reversal. 2 target are done now waiting for 41463/41694

All Target done as per Outside Bar Pattern.

Traders may watch out for potential intraday reversals at 10:01,11:44, 12:17, 1:05, and 2:44. How to Find and Trade Intraday Reversal Times

Bank Nifty March Futures Open Interest Volume stood at 22.4 lakh, witnessing a liquidation of 1.6 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a closure of long positions today.

The Bank Nifty Rollover cost currently stands at 40733, and once this level was crossed, it triggered a significant rally

The price is once again approaching the crucial 30 SMA Level at 41412, and this level will be crucial on Wednesday.

Bank Nifty’s price is approaching the 50% point at 41785, which may trigger a new trend in the market.

According to the musical octave trading path, Bank Nifty may follow the path of 41024-41430-41883, so traders should take a position and ride the move.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 42000 strike, followed by the 42300 strike. On the put side, the 41000 strike has the highest OI, followed by the 40500 strike. This indicates that market participants anticipate Bank Nifty to stay within the 41000-42000 range.

The Bank Nifty options chain shows that the maximum pain point is at 41300 and the put-call ratio (PCR) is at 0.94. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. This suggests that Bank Nifty may trade within a range of 41000-42000 levels in the near term

To outperform the market and to succeed in trading, a trader needs to take charge of his emotions. To start off, he requires a patient and confident mind.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 40728. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 41603 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels:

-

Buy above 41465 with targets at 41585, 41729, and 41920 (Bank Nifty Spot Levels)

-

Sell below 41300 with targets at 41182, 41014, and 40865 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.