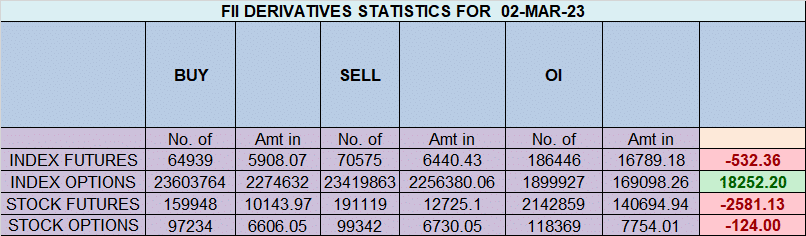

FII sold 5.6 K contract of Index Future worth 532 cores, Net OI has decreased by 10.7 K contract 8.1 K Long contract were covered by FII and 2.5 K Shorts were covered by FII. Net FII Long Short ratio at 0.17 so FII used fall to exit Long and exit short in Index Futures.

As Discussed in Last Analysis Price bounced for 1×1 gann angle as shown below Gann Chart . Mercury Ingress is happening tommrow so we can see Bumper expiry.Watch for first 15 mins to get the trend for the day.

Nifty is back to gann 1×1 angle today being Venus Conjuct Jupiter Aspect and Mercury Ingress, Venus and Mercury has a major Impact on Nifty. India’s Adani group gets $1.87 bln investment from U.S. firm GQG

Trading has been diffcult for swing traders with YO YO move coming in Nifty but tommrow as we have weekly closing Bulls would like to close above 17428-17444 range.

Swing Trader above 17386 can see move towards 17452/17517/17583. Bears will get active below 17320 for a move towards 17255/17166/17108

Intraday time for reversal can be at 0:08/12:04/1:35/2:40 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17400 PCR at 0.74 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Nifty Rollover cost @17844 and 67.6 % rollover is done.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 17,500 strike, followed by 17,600 strikes. On the put side, the highest OI is at the 17300 strike, followed by 17200 strikes. This suggests that the market participants are expecting Nifty 50 to remain range-bound between 17300-17500 levels.

FII’s bought 12770 cores and DII’s bought 2128 cores in cash segment.

#NIFTY50 as per musical octave trading path can be 17804-17538-17274 take the side and ride the move !!

Traders who can manage their emotions effectively are better equipped to make rational decisions in the market. Emotions such as fear, greed, and hope can cloud a trader’s judgment, leading to poor decision-making and losses.

Positional Traders Trend Change Level is 17512 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 17432 will act as a Intraday Trend Change Level.