FII sold 15.5 K contract of Index Future worth 1357 cores, Net OI has increased by 10.6 K contract 2.4 K Long contract were covered by FII and 13 K Shorts were added by FII. Net FII Long Short ratio at 0.17 so FII used fall to exit Long and enter short in Index Futures.

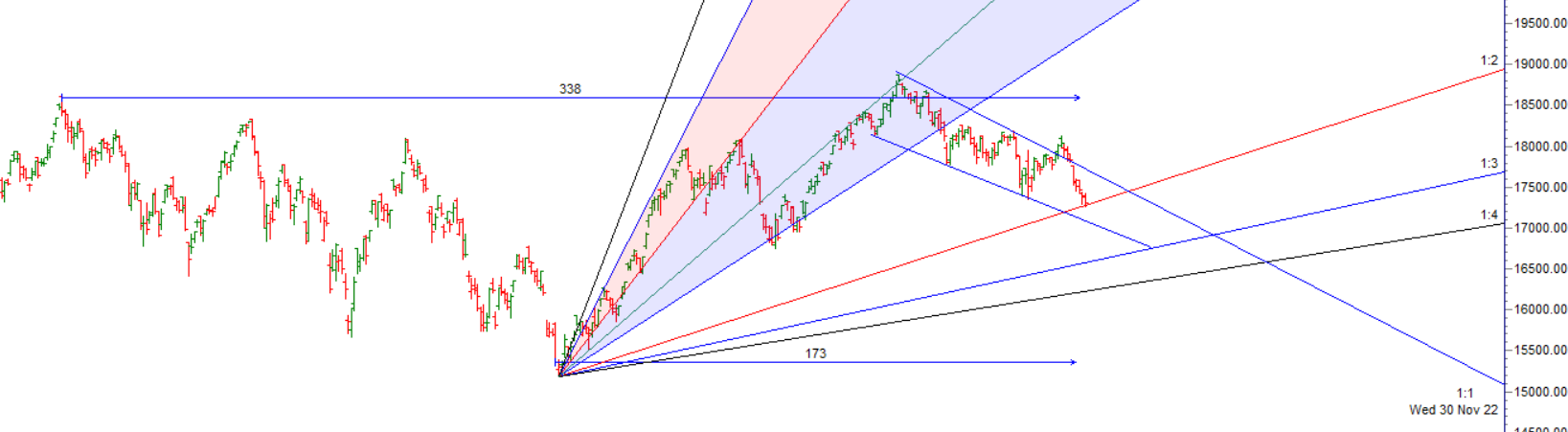

As Discussed in Last Analysis Today is 8th consecutive red candle on the Daily charts,Bullish Pin Bar near Gann Angle Support as shown in below chart and today was the day when Budget day Low got breached and price touched its 200 DMA if this low holds then expect a move till 17560/17693/17825. We have Monthly Close tommrow so watch for 3 PM tommrow for a spike in nifty. On MOnthly time frame this will be 3 Red Candel.

Nifty Falls for 9 Days in Row, when last time it happened we have discussed in below video. Price continue to hold 1×1 gann angle but closed below the 200 DMA.

Swing Trader above 17354 can see move towards 17420/17487/17553. Bears will get active below 17288 for a move towards 17221/17166/17089

Intraday time for reversal can be at 10:28/12:31/1:43/2:40 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17400 PCR at 0.92 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Retailers have bought 180 K CE contracts and 94 K CE contracts were shorted by them on Put Side Retailers sold 399 K PE contracts and 321 K PE shorted contracts were added by them suggesting having neutral outlook.

FII bought 69.6 K CE contracts and 67.2 K CE were shorted by them, On Put side FII’s bought 1.4 K PE and 15 K PE were shorted by them suggesting they have a turned to neutral Bias.

Nifty Rollover cost @17844 and 67.6 % rollover is done.

Maximum Call open interest of 36 lakh contracts was seen at 17500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 33 lakh contracts was seen at 17200 strike, which will act as a crucial Support level

FII’s sold 4559 cores and DII’s bought 4610 cores in cash segment.INR closed at 82.60

#NIFTY50 as per musical octave trading path can be 17804-17538-17274 take the side and ride the move !!

One of the tactics of avoiding fear is to conduct due diligence before entering a trade by doing your analysis. Once that is done, let the trade run to maturity. Walk away from it if necessary and avoid watching EVERY TICK

Positional Traders Trend Change Level is 17535 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 17432 will act as a Intraday Trend Change Level.