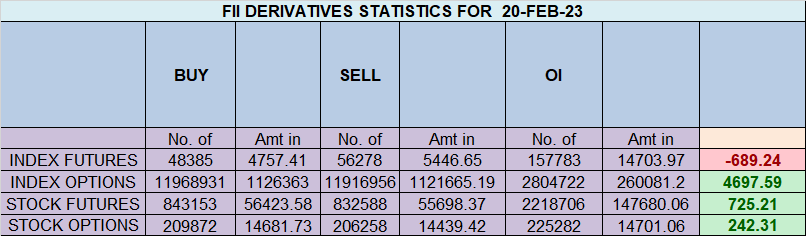

FII sold 7.8 K contract of Index Future worth 689 cores, Net OI has increased by 6.7 K contract 574 Long contract were covered by FII and 7.3 K Shorts were added by FII. Net FII Long Short ratio at 0.28 so FII used fall to enter exit and enter short in Index Futures.

Nifty is back to its 50% point 17817 price has been in sideways move trading between 37.5-50-62.5 range. Nifty has closed just at its 20 DMA, Its tough time for trend followers as market are lacklusture. As a trader we need to adjust as per market moves.

Nifty Swing Trade Plan as per Intraday Ratio Indicator based on Double Ingress Astro Date

Intraday time for reversal can be at 9:15/10:59/12:50/1:51/2:36 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17900 PCR at 0.61 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Retailers have bought 132 K CE contracts and 113 K CE contracts were shorted by them on Put Side Retailers bought 325 K PE contracts and 336 K PE shorted contracts were added by them suggesting having BULLISH outlook.

FII bought 112 K CE contracts and 84 K CE were shorted by them, On Put side FII’s bought 82.7 K PE and 58.7 K PE were shorted by them suggesting they have a turned to neutral Bias.

Maximum Call open interest of 16 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 53 lakh contracts was seen at 17800 strike, which will act as a crucial Support level

Nifty Bulls now need to move above 17891 till than Bears have upper hand.

FII’s sold 158 cores and DII’s bought 86 cores in cash segment.INR closed at 82.60

#NIFTY50 as per musical octave trading path can be 18066-17800-17533 take the side and ride the move !!

Understand that you will lose on more trades than you will win on; that is just part of the game. If you are the type that always has to be “right” you are going to have a hard time becoming a successful trader. The market is perpetual, it continues on no matter what you think about it with no knowledge that you exist.

Positional Traders Trend Change Level is 17852 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 17916 will act as a Intraday Trend Change Level.