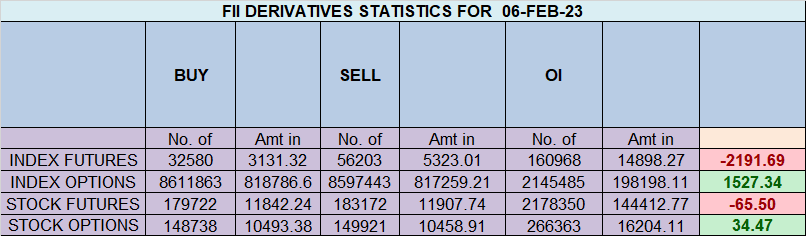

FII sold 23.6 K contract of Index Future worth 2191 cores, Net OI has increased by 20.7 K contract 1.4 Long contract were covered by FII and 22.1 K Shorts were added by FII. Net FII Long Short ratio at 0.18 so FII used fall to exit Long and enter short in Index Futures.

Now “Bayer Rule 2: Trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes. Leads to Big Move ” we are moving into crucial range of 17870-17900 which bulls need to cross for the rally to continue towards 18025-18070-18225.

High made was 17823 so bulls were unable to cross the range of 17870-17900 range and saw a fall in Nifty Bayer Rule 9: Big changes on market are when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius,also over 24 degrees 14 minutes of Capricorn. got in effect today as explained in below video.

SO we can expect big move in nifty and Reliance in next 2 days. For Swing Traders Bulls will get active above 17832 for a move towards 17883/17951/18011/18059. Bears will get active below 17689 for a move towards 17637/17569/17509/17461.

Intraday time for reversal can be at 9:51/11:11/11:53/1:43/2:28 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17750 PCR at 0.99 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Maximum Call open interest of 30 lakh contracts was seen at 17900 strike, which will act as a crucial resistance level and Maximum PUT open interest of 20 lakh contracts was seen at 17500 strike, which will act as a crucial Support level

Nifty Feb Future Open Interest Volume is at 1 Cr with liquidation of 6.8 Lakh with increase in Cost of Carry suggesting Long positions were closed today.

Nifty Rollover cost @18169 and Rollover % @75 Closed below it.

Retailers have bought 119 K CE contracts and 959 K CE contracts were shorted by them on Put Side Retailers bought 315 K PE contracts and 397 K PE shorted contracts were added by them suggesting having BULLISH outlook.

FII bought 73.3 K CE contracts and 129 K CE were shorted by them, On Put side FII’s bought 96 K PE and 25 K PE were shorted by them suggesting they have a turned to neutral Bias.

Nifty Bulls now need to hold 17749 for trend to remain buy on dips.

FII’s sold 1218 cores and DII’s bought 1203 cores in cash segment.INR closed at 82.78

#NIFTY50 as per musical octave trading path can be 17274-17538-17804-18072 take the side and ride the move !!

You cannot achieve mastery with a mediocre effort. If you want big returns in the stock market, you must make your trading a priority.

Positional Traders Trend Change Level is 17782 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 17801 will act as a Intraday Trend Change Level.