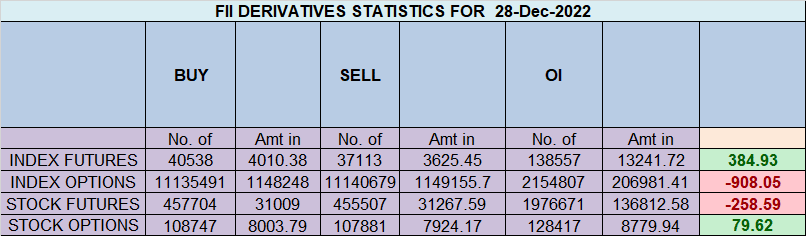

FII bought 3.4 K contract of Index Future worth 384 cores, Net OI has decreased by 2.2 K contract 580 Long contract were added by FII and 2.8 K Shorts were covered by FII. Net FII Long Short ratio at 0.92 so FII used fall to enter Long and exit short in Index Futures.

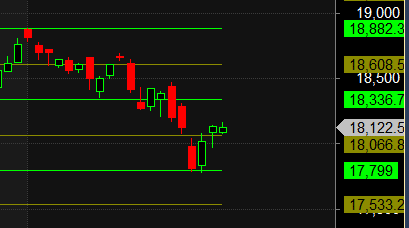

Bulls were able to close above 18040 and almost did 2 target now waiting for 18240/18307 till holding 18107. Bears will get active below 18036 for a move towards 17974/17907. Tommrow Bayer Rule 9: Big changes on market are when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius,also over 24 degrees 14 minutes of Capricorn will get activated.

Intraday traders can use 15 mins high and low to trade for the day. Swing Follow levels as mentioned above.

Nifty has formed NR7 pattern today with range lowest in last 7 days and tommrow being an important vibration date as disussed below, so we can see the big move.

MAX Pain is at 18300 PCR at 1.05 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Maximum Call open interest of 62 lakh contracts was seen at 18300 strike, which will act as a crucial resistance level and Maximum PUT open interest of 52 lakh contracts was seen at 18000 strike, which will act as a crucial Support level

Retailers have bought 593 K CE contracts and 482 K CE contracts were shorted by them on Put Side Retailers bought 385 K PE contracts and 380 K PE shorted contracts were added by them suggesting having NEUTRAL outlook.

FII bought 2 K CE contracts and 778 CE were shorted by them, On Put side FII’s sold 5.4 K PE and 11.8 K PE were shorted by them suggesting they have a turned to BULLISH Bias.

Nifty Jan Future Open Interest Volume is at 0.77 Cr with addition of 20.3 Lakh with increase in Cost of Carry suggesting Long positions were added today.

Nifty Rollover cost @18392 and Rollover % @75.1 Closed below it.

Till Nifty is above 18061 on closing basis price can rally till 18275/18414

FII’s sold 872 cores and DII’s bought 372 cores in cash segment.INR closed at 81.89

#NIFTY50 as per musical octave trading path can be 17799-18066-18336 take the side and ride the move !!

“When you really believe that trading is simply a probability game, concepts like right or wrong or win or lose no longer have the same significance.” – Mark Douglas

Positional Traders Trend Change Level is 18075 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18130 will act as a Intraday Trend Change Level.