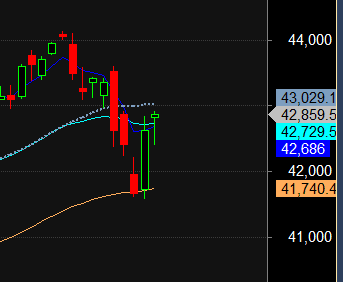

Bayers rule showed its impact and Bank Nifty did all target on upside. For Swing Traders Bulls need to move above 42792 for a move towards 42996/43200/43444. Bears will get active below 42385 for a move towards 42181/41977/41773.

Bulls were able to close above 42792 now waiting for 42996/43200/43444. Bears will get active below 42512 for a move towards 42305/42098. Tommrow Bayer Rule 9: Big changes on market are when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius,also over 24 degrees 14 minutes of Capricorn will get activated.

Intraday traders can use 15 mins high and low to trade for the day. Swing Follow levels as mentioned above.

Intraday time for reversal can be at 9:29/10:39/11:29/12:16/1:54 How to Find and Trade Intraday Reversal Times

Bank Nifty Jan Future Open Interest Volume is at 13.2 lakh with addition of 4.2 Lakh contract , with decrease in Cost of Carry suggesting Long positions were added today.

Bank Nifty Rollover cost @42828 and Rollover % @81.3 Closed above it,

Bank Nifty above 42720 on closing basis can lead to relief rally till 43012.

Maximum Call open interest of 55 lakh contracts was seen at 43000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 55akh contracts was seen at 42500 strike, which will act as a crucial Support level.

MAX Pain is at 43000 and PCR @1.06 . Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

“When you really believe that trading is simply a probability game, concepts like right or wrong or win or lose no longer have the same significance.” – Mark Douglas

For Positional Traders Trend Change Level is 42766 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 42658 will act as a Intraday Trend Change Level.