Stock Markets have seen high volatile move in last week and Small Cap Stocks have seen big corrections last week, Small-cap stocks lost a hefty grip as they tumbled by a huge 1,168.84 points

All indexes in broader markets were trapped in deep red with a downside ranging from 2-4% with small-caps being the worst hit.

The 52-week high/low levels, wherein the stock or index crosses one-year high/low, are considered vital indicators in markets as breaching these levels are seen as a confirmation that the trend is likely to continue, with ferocity, in the respective direction.

Investors and traders believe that the stock crossing the 52-week high or low level has a firm underlying strength / weakness, which may lead to a secular movement in the counter. In general, 52-week high represents a resistance level and 52-week low the support levels, and their breach is considered a key for trend to continue

52-Weeks High Effect in Stocks

The “52-week high effect” states that stocks with prices close to the 52-week highs have better subsequent returns than stocks with prices far from the 52–week highs. Investors use the 52-week high as an “anchor” which they value stocks against. When stock prices are near the 52-week high, investors are unwilling to bid the price all the way to the fundamental value. As a result, investors’ under-react when stock prices approach the 52-week high, and this creates the 52-week high effect.

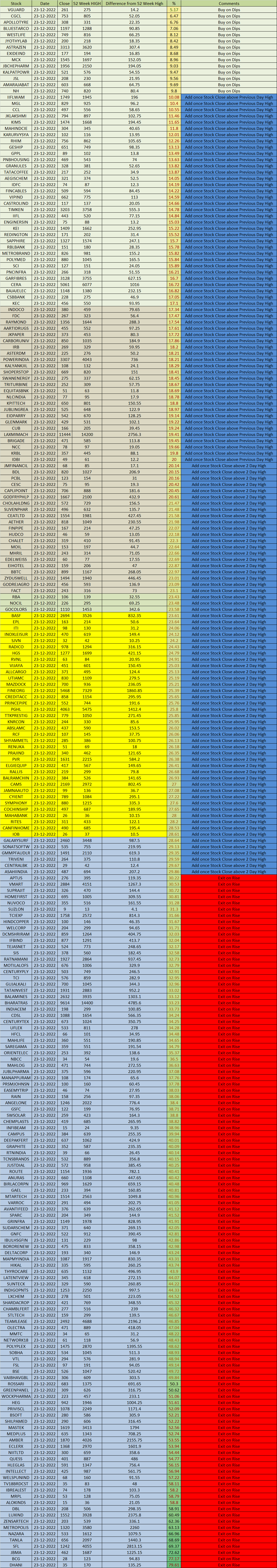

Below are the List of Stocks of Small Cap Index and % away from their respective 52 Week High. Stocks which have seen dip till 10-15% should be added in the Portfolio. Link for Google Sheet