FII bought 4.5 K contract of Index Future worth 513 cores, Net OI has decreased by 5.4 K contract 435 Long contract were covered by FII and 4.9 K Shorts were covered by FII. Net FII Long Short ratio at 1.22so FII used fall to exit Long and exit short in Index Futures.

As Discussed first 15 mins low was broken and nifty had a decent fall, North Node showed its impact.Nifty has strong support in range of 18351-18323, if tommrow we open gap down look for this range for support.

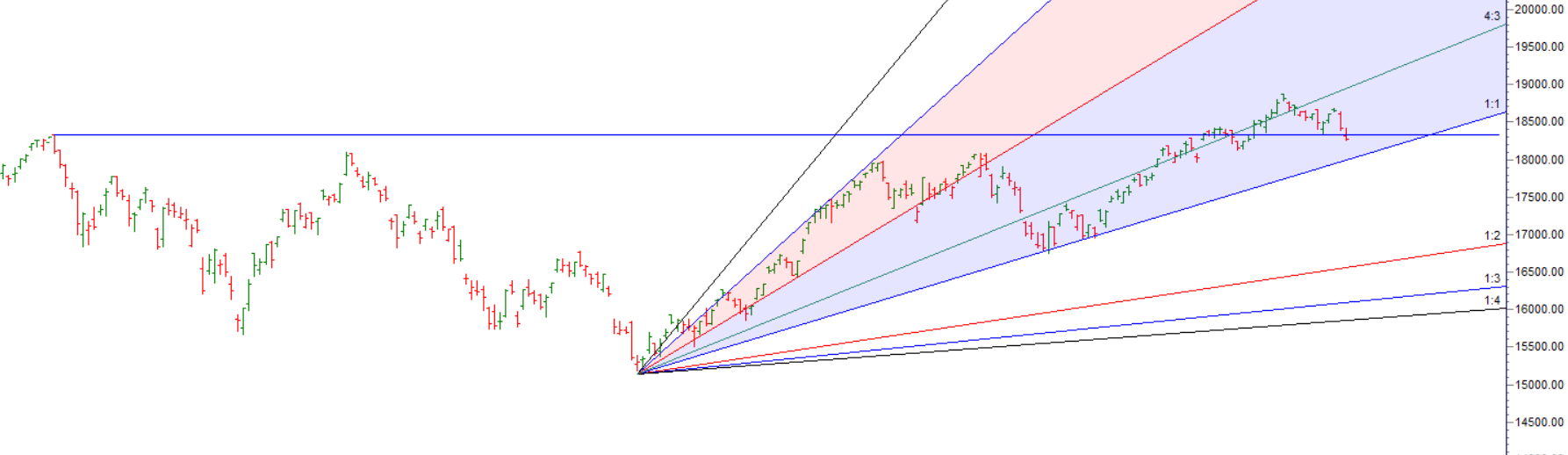

Nifty has fallen for 3 days in a row and 441 points in total, price has closed below 20 DMA, and we have important astro/gann date coming on 19-20 Dec so trade cautiously as next week we will see atleast 500 points move in Nifty.

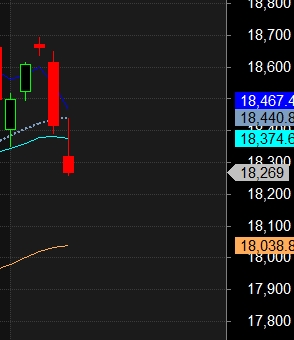

Swing Plan Bulls need to move above 18311 for a move towards 18379/18448 . Bears will get active below 18243 for a move towards 18174/18106

MAX Pain is at 18300 PCR at 0.88 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Retailers have bought 116 K CE contracts and 112 K CE contracts were shorted by them on Put Side Retailers bought 70.3 K PE contracts and 72.9 K PE shorted contracts were added by them suggesting having NEUTRAL outlook.

FII bought 204 K CE contracts and 134 K CE were shorted by them, On Put side FII’s bought 99.9 K PE and 93.1 K PE were shorted by them suggesting they have a turned to NEUTRAL Bias.

Maximum Call open interest of 52 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 42 lakh contracts was seen at 18300 strike, which will act as a crucial Support level

Nifty Dec Future Open Interest Volume is at 1.04 Cr with liquidation of 4.7 Lakh with increase in Cost of Carry suggesting Long positions were closed today.

Nifty Rollover cost @18392 and Rollover % @75.1 Closed above it.

Till Nifty is below 18374 on closing basis Bears will have upper hand.

FII’s sold 1975 cores and DII’s bought 1542 cores in cash segment.INR closed at 81.76

#NIFTY50 as per musical octave trading path can be 18058-18595-19132 take the side and ride the move !!

We Must Realize That The Market Defies Logic. It Has A Logic All Its Own, And It Won’t Tell Us In Advance What Its Reaction To Events Will Be. We Can Watch For Clues And Then React.

Positional Traders Trend Change Level is 18701 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18392 will act as a Intraday Trend Change Level.