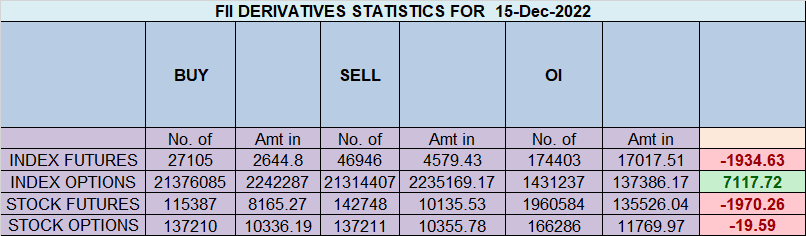

FII sold 19.8 K contract of Index Future worth 1934 cores, Net OI has increased by 467 contract 9.6 K Long contract were covered by FII and 10.1 K Shorts were added by FII. Net FII Long Short ratio at 1.15 so FII used rise to exit Long and enter short in Index Futures.

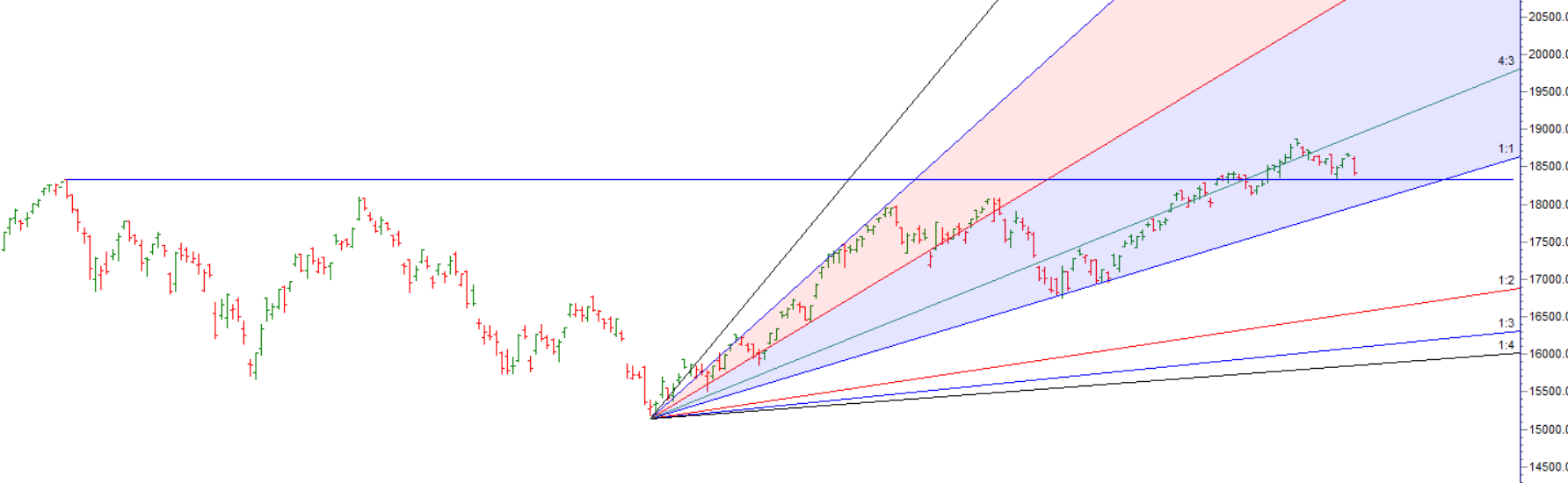

Nifty continue to march higher and formed an NR7 pattern, we will open slight gap down today, First 15 mins High and low will decide trend for the day as Mercury Trine North Node, North Node brings volatlity in the market so today we might see some volatile move. Use Swing and Intraday Level as mentioned.

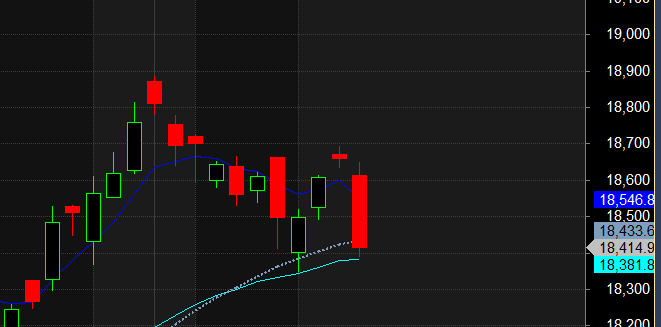

As Discussed first 15 mins low was broken and nifty had a decent fall, North Node showed its impact.Nifty has strong support in range of 18351-18323, if tommrow we open gap down look for this range for support.

Swing Plan Bulls need to move above 18354 for a move towards 18422/18491 . Bears will get active below 18285 for a move towards 18217/18149

MAX Pain is at 18650 PCR at 0.88 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Retailers have bought 595 K CE contracts and 405 K CE contracts were shorted by them on Put Side Retailers bought 210 K PE contracts and 252 K PE shorted contracts were added by them suggesting having NEUTRAL outlook.

FII sold 68.3 K CE contracts and 2 K shorted CE were covered by them, On Put side FII’s sold 19.4 K PE and 44.3 K PE were shorted by them suggesting they have a turned to NEUTRAL Bias.

Maximum Call open interest of 52 lakh contracts was seen at 18700 strike, which will act as a crucial resistance level and Maximum PUT open interest of 42 lakh contracts was seen at 18500 strike, which will act as a crucial Support level

Nifty Dec Future Open Interest Volume is at 1.05 Cr with liquidation of 0.44 Lakh with increase in Cost of Carry suggesting Long positions were closed today.

Nifty Rollover cost @18392 and Rollover % @75.1 Closed above it.

Nifty Bulls are back with the close above 18599

FII’s bought 372 cores and DII’s bought 926 cores in cash segment.INR closed at 81.49

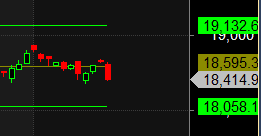

#NIFTY50 as per musical octave trading path can be 18058-18595-19132 take the side and ride the move !!

In trading, the objective is to win swiftly whenever possible. It is all about knowing how to handle the trade in accordance with the trading strategy and time frame

Positional Traders Trend Change Level is 18729 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18769 will act as a Intraday Trend Change Level.

Hi Sir…

Today nifty closing price is 18414…but given levels for sell is 18599….

Please recheck and update …if necessary!

we have correted it