Bayers Rule will come into effect from tommrow as discussed in below video, Swing Trade Plan as per Intraday Ratio Indicator is as show below. We have monthly close tommrow so last 45 mins we will see volatlity.

We saw the impact of last 45 min move due to MSCI rebalacing , Bank Nifty did underperformance today as compared to Nifty.

Tommorow we have important bayers rule coming into effect so first 15 mins High and Low will guide for Intraday.

Bayer Rule 30: The trend changes when Venus in declination passes the extreme declination of the Sun.

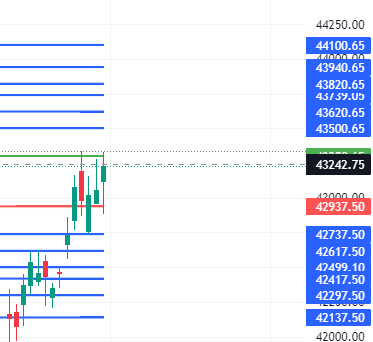

For Swing Trade Bulls need to move above 43300 for a move towards 43500/43620/43739/43820 . Bears will get active below 42937 for a move towards 42737/42617/42499.

Intraday time for reversal can be at 10:49/11:16/12:39/1:31/2:28 How to Find and Trade Intraday Reversal Times

Bank Nifty Dec Future Open Interest Volume is at 28.3 lakh with liquidation of 0.14 Lakh contract , with decrease in Cost of Carry suggesting Long positions were added today.

Bank Nifty Rollover cost @42828 and Rollover % @81.3 Closed above it, Bank NIfty Future is in premium has reduced towards 221 points.

Till Bank Nifty is above 42982 on closing basis Bulls will have upper hand.

Maximum Call open interest of 42 lakh contracts was seen at 43500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 44 lakh contracts was seen at 43000 strike, which will act as a crucial Support level.

MAX Pain is at 43300 and PCR @0.88 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

LEARN TO EXECUTE ORDERS QUICKLY. Practice your execution skills daily. Create speed drills for yourself, Being fast and light is an advantage that the intraday trader must learn to exploit. We can go from long to short very quickly and easily.

For Positional Traders Trend Change Level is 43294 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 43320 will act as a Intraday Trend Change Level.

I like NIFTY and BANKNIFTY analysis.

Good job.

thanks