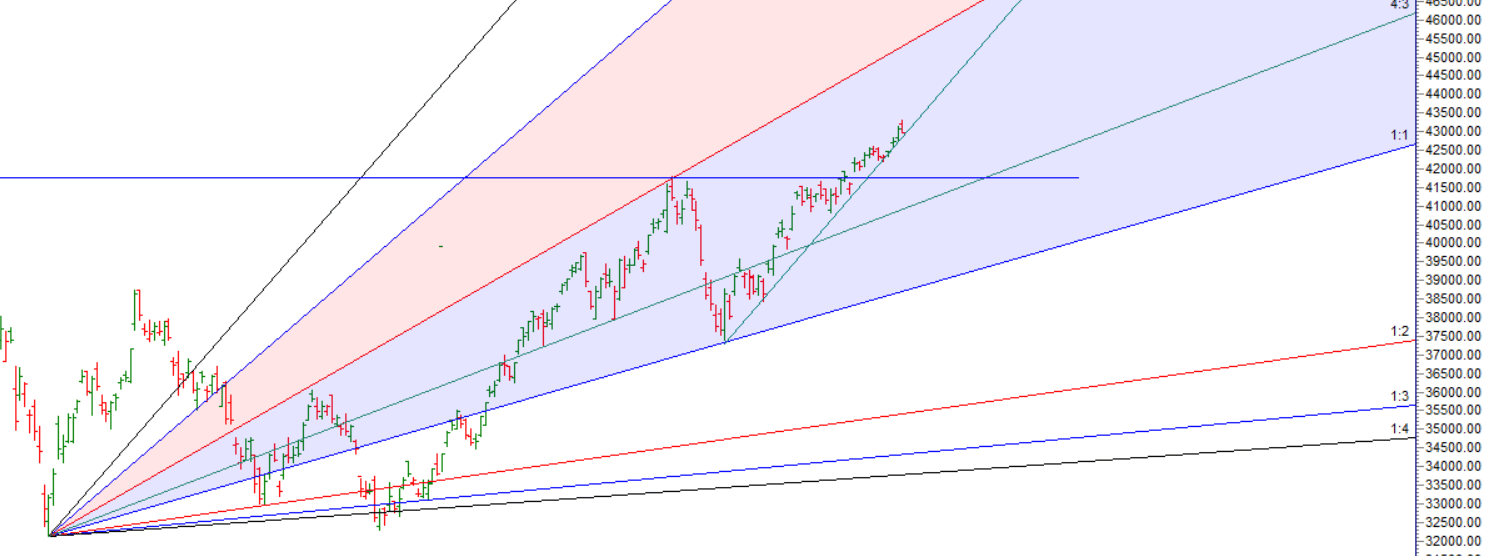

Bank Nifty did 43000 and we saw the impact of Jupiter Plannet as bank nifty moved in last 2 trading session only and the red line (Gann Master Level Indicator) as shown in below chart lead to move of 400+ points, Price generally give 500-729-1008 points move from red line.

Bank Nifty again got its correction from purple line based on (Gann Master Level Indicator) ON 28 we have Venus Yod Uranus and Mercury Square Jupiter HELIO Aspect which is crucial for Global Market , Uranus is Stock Market plannet so will have big impact on Global Stock Market.

For Swing Trade Bulls need to move above 43131 for a move towards 43339/43640/43846 . Bears will get active below 42818 for a move towards 42613/42408/42202.

Intraday time for reversal can be at 9:38/10:35/11:17/11:58/1:07/2:05/2:52 How to Find and Trade Intraday Reversal Times

Bank Nifty Dec Future Open Interest Volume is at 27.9 lakh with liquidation of 2.4 Lakh contract , with decrease in Cost of Carry suggesting Long positions were closed today.

Bank NIfty Rollover cost @42828 and Rollover % @81.3.. CLosed above it, Bank NIfty Future is in 308 points premium to Spot.

Traders who do arbritrage can Sell Dec Future and Buy Jan Future Margin required is just 25-30K per lot and hold till expiry.

Till Bank Nifty is above 42732 on closing basis Bulls will have upper hand.

Maximum Call open interest of 22 lakh contracts was seen at 43500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 24 lakh contracts was seen at 42500 strike, which will act as a crucial Support level.

MAX Pain is at 43000 and PCR @1.12 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Traders should evaluate their execution, not their P&L.

For Positional Traders Trend Change Level is 43258 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 43321 will act as a Intraday Trend Change Level.