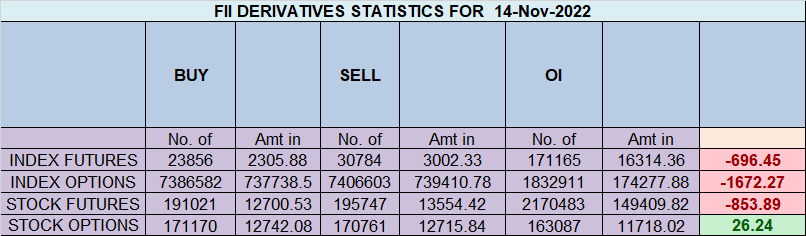

FII sold 6.9 K contract of Index Future worth 696 cores, Net OI has decreased by 2.5 K contract 4.7 K Long contract were covered by FII and 2.2 K Shorts were added by FII. Net FII Long Short ratio at 1.53 so FII used fall to exit long and enter short in Index Futures.

Above 15 Mins High Nifty moved towards day high.

Range of 18555-18595 is crucial supply zone as per gann angle, should be used to lighten up longs.

Nifty has also closed at 18350 which is Jan 2022 high and also closed above Astro date and waiting for higher target of 18417/18484/18550, Till Nifty is above 18225 Bulls have upper hand.

Low made 18311 so bulls were able to protect 18225 and closed above 18305 again, VIX has come down significantly so we can see lower voaltile moves for next few days. Sautrn Jupiter coming at 40 degree and Mercury MAx distance from earth it take 2-3 days for long term plannet to show impact. 16-17 Mercury and Venus are going in Ingress so can lead to trending move after 2 days.

Nifty Swing Trade Plan based on Astro Date High and Low is as below. Till we are holding 18305 move towards 18417/18484/18550. Bears will get active below 18263 for a move towards 18196/18128/18060.

For Swing Traders Bulls will get active above 18305 for a move towards 18417/18484/18550. Bears will get active below 18107 for a move towards 17996/17928/17862, Swing Shorts were not intiated due to gap down,

Intraday time for reversal can be at 9:15/10:05/10:47/11:20/12:25/1:35/2:34 How to Find and Trade Intraday Reversal Times

MAX Pain is at 18400 PCR at 0.85 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 32 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 38 lakh contracts was seen at 18100 strike, which will act as a crucial Support level

Nifty Nov Future Open Interest Volume is at 1.19 Cr with liquidation of 3.95 Lakh with decrease in cost of carry suggesting Long positions were closed today.

Retailers have bought 775 K CE contracts and 607 K CE contracts were shorted by them on Put Side Retailers bought 155 K PE contracts and 221 K PE shorted contracts were added by them suggesting having BULLISH outlook.

FII bought 13.4 K CE contracts and 63.1 K CE were shorted by them, On Put side FII’s bought 0.12 K PE and 28.3 K shorted PE were covered by them suggesting they have a turned to BEARISH Bias.

FII’s bought 1089 cores and DII’s bought 47 cores in cash segment.INR closed at 82.15

#NIFTY50 as per musical octave trading path can be 17551-18058-18595 take the side and ride the move !! 2 days in a row closed above 18058

Do not trade with tiny account, Its better to paper trade and build yourself until there is reasonable amount in your account. The market will wait for you. You want odds to be with you not against you, so be patient with right amount of capital.

Positional Traders Trend Change Level is 18127 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18407 will act as a Intraday Trend Change Level.