We will see Gap up open tommrow as US data came better than expected and Dollar Index is down to 108 so should be positive for USD and Banks.

CPI 0.4% M/M, Exp. 0.6%

CPI 7.7% Y/Y, Exp. 7.9%

CPI Core 0.3% M/M, Exp. 0.5%

CPI Core 6.3% Y/Y, Exp. 6.5%

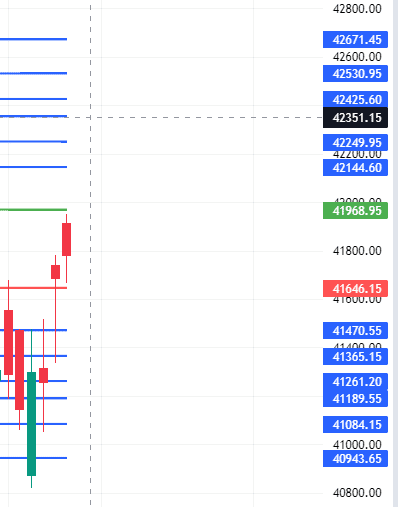

Bank Nifty just closed above 41353 Mars Reteograde level and also we closed above the TC level.

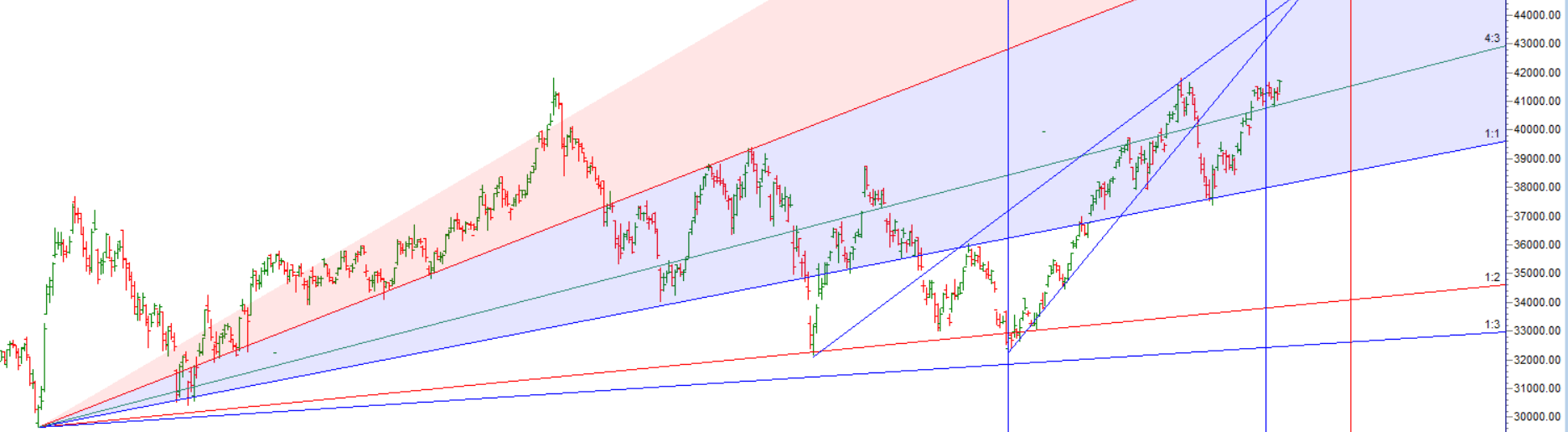

Bayer Rule 9: Big changes on market are when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius,also over 24 degrees 14 minutes of Capricorn. Expect Good Move in Nifty as this rule becomes active.

Bank Nifty Swing Trade Plan based on Astro Date High and Low.

For Swing Trade Bulls need to move above 41968 for a move towards 42144/42249/42425. Bears will get active below 41646 for a move towards 41470/41365/41261/41084. , Swing Shorts were not intiated due to gap down,

Intraday time for reversal can be at 9:15/12:23/1:02/2:08/2:53 How to Find and Trade Intraday Reversal Times

Bank Nifty Nov Future Open Interest Volume is at 22.7 lakh with liquidation of 1.1 Lakh contract , with increase in Cost of Carry suggesting Long positions were closed today.

Bank Nifty Rollover cost @ 41285 and Rollover is at 76.5 % Closed above it

Maximum Call open interest of 18 lakh contracts was seen at 42000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 12 lakh contracts was seen at 41500 strike, which will act as a crucial Support level.

MAX Pain is at 42000 and PCR @0.85 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

During this phase of the rule-finding and the clean implementation of your Trading system you are faced with mental conflicts. That’s the hardest part of the Trading education to resolve “Mental Conflicts”.

For Positional Traders Trend Change Level is 41531 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 41633 will act as a Intraday Trend Change Level.