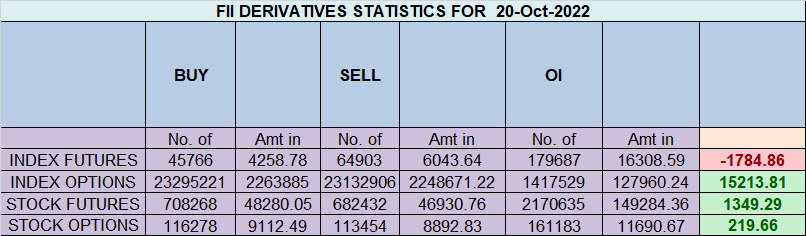

FII sold 19.1 K contract of Index Future worth 1784 cores, Net OI has increased by 25.5 K contract 3.2 K Long contract were added by FII and 22.3 K Shorts were added by FII. Net FII Long Short ratio at 0.37 so FII used rise to enter long and enter short in Index Futures.

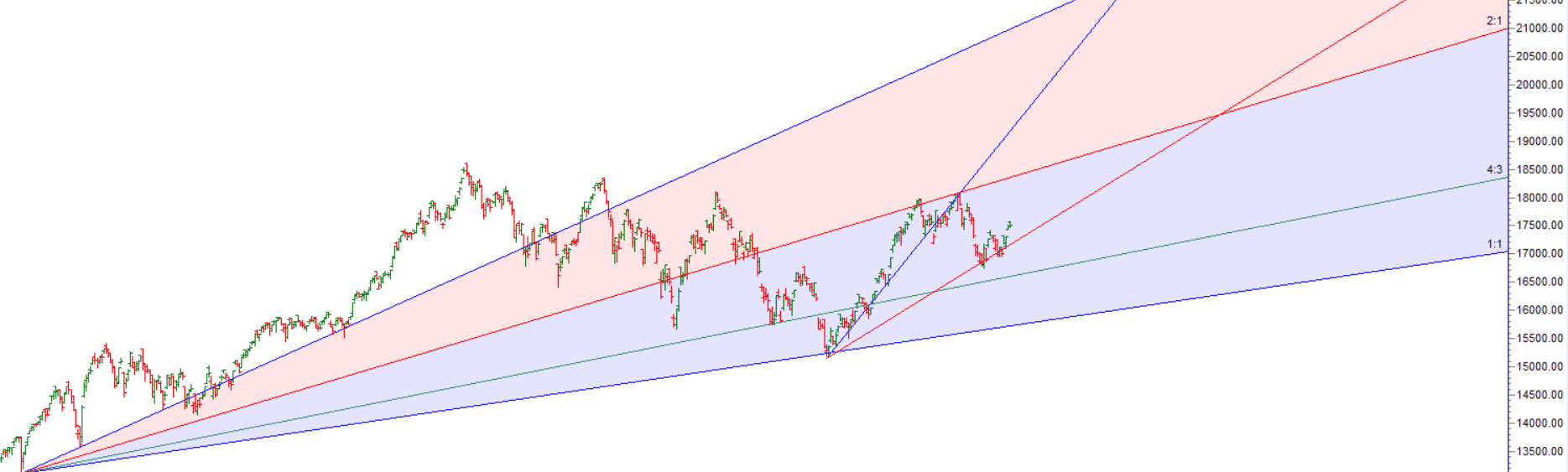

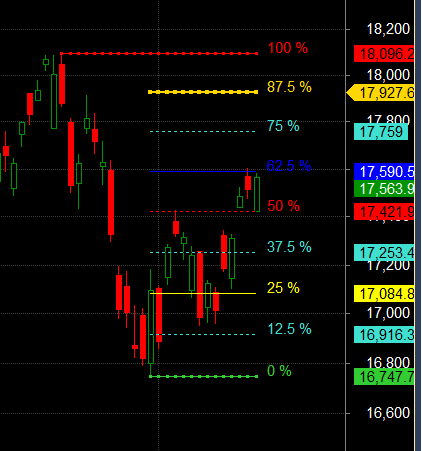

Nifty has touched the musical octave level as show im below chart. 17551-17576 Nifty need to close above this supply range for upmove to continue, TIll 17421 is held Bulls have upper hand Bulls need to close above 17538 for a move towards 17605/17671/17737. Bears will get active below 17408 for a move towards 17342/17275/17209.

Low made was 17421 and we saw a decent rally. TIll 17421 is held Bulls have upper hand Bulls need to close above 17610 for a move towards 17666/17729/17800. Bears will get active below 17408 for a move towards 17342/17275/17209. Lot of Astro Event are coming in Next week better aviod carrying overnight positions and njoy the Diwali Holidays.

17421 is Gann 50% level which gann has give lot of importance. Break of 17421 we will see a fast rise towards 17590. — 17590 done. Now above 17590 can lead to rally towards 17759

Intraday time for reversal can be at 9:16/10:41/11:35/12:19/1:41/2:42 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17600 PCR at 0.98 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 42 lakh contracts was seen at 17600 strike, which will act as a crucial resistance level and Maximum PUT open interest of 45 lakh contracts was seen at 17400 strike, which will act as a crucial Support level

We have Tripple Ingress happening on 23 Oct as SUn Venus and Saturn are changing sign, Its a very Rare Event, Last time we had double ingress on 19-Dec-21/06Mar-22/29 APr-22/10-May-22/05 and 19 Jul observe what has happened on these days.

Nifty Oct Future Open Interest Volume is at 1.13 Cr with additiom of 3.5 Lakh with increase in cost of carry suggesting Long positions were added today.

NIfty Rollover cost @ 17028 and Rollover is at 73.4 % closed above it.

FII’s bought 1864 cores and DII’s sold 886 cores in cash segment.INR closed at 82.70

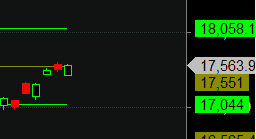

#NIFTY50 as per musical octave trading path can be 17044-17551-18058 take the side and ride the move !!

Studies show that traders avoid risk when winning and seek risk when losing. This is the exact opposite of what needs to done to sustain in the markets. We must reprogram ourselves and create habits that are unnatural until they become our second nature.

Positional Traders Trend Change Level is 17207 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 17472 will act as a Intraday Trend Change Level.