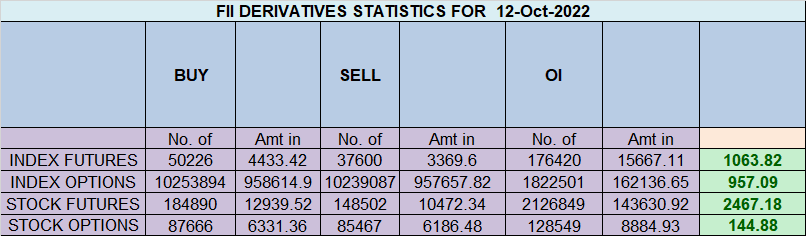

FII bought 12.6 K contract of Index Future worth 1063 cores, Net OI has increased by 5.2 K contract 8.9 K Long contract were added by FII and 3.7 K Shorts were covered by FII. Net FII Long Short ratio at 0.23 so FII used rise to enter long and exit short in Index Futures.

We are having Few Important aspect tommrow which Involves Mercury,Pluto and Uranus which will have big impact on World Markets.

- Venus YOD Uranus — Key Dates Imp for Global Market

- Mercury Opposition Pluto HELIO — Important Turning Point

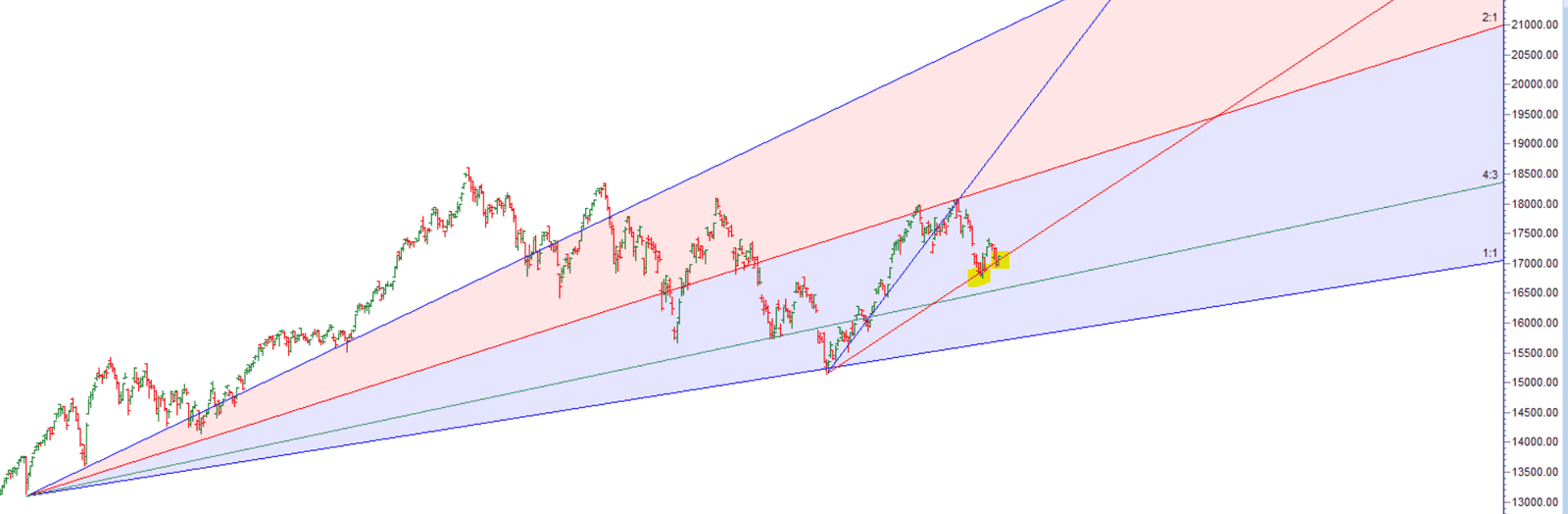

Also price has bounced from 200 DMA and Gann angle as shown in below chart. For Tommrow First 15 Mins High and Low will guide for the day.

For Swing Traders Bulls will get active above 17155 for a move towards 17220/17285/17350. Bears will get active below 17025 for a move towards 16960/16898/16816

Intraday time for reversal can be at 9:42/11:21/12:13/1:56/2:17/2:59 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17100 PCR at 0.78 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 42 lakh contracts was seen at 17200 strike, which will act as a crucial resistance level and Maximum PUT open interest of 55 lakh contracts was seen at 17000 strike, which will act as a crucial Support level

Retailers have sold 413 K CE contracts and 213 K CE contracts were shorted by them on Put Side Retailers bought 768 K PE contracts and 572 K PE shorted contracts were added by them suggesting having BEARISH outlook.

FII sold 3.5 K CE contracts and 36 K CE were shorted by them, On Put side FII’s bought 44 K PE and 61 K PE were shorted by them suggesting they have a turned to Bullish Bias.

Nifty Oct Future Open Interest Volume is at 1.32 Cr with liquidation of 1.28 Lakh with decrease in cost of carry suggesting Short positions were closed today.

NIfty Rollover cost @ 17028 and Rollover is at 73.4 % closed above it.

FII’s sold 542 cores and DII’s bought 85 cores in cash segment.INR closed at 82.45

#NIFTY50 as per musical octave trading path can be 16565- 17044-17551 take the side and ride the move !!

Anyone can become a trader and overcome his or her fears. Provided that people are not clinically ill, they can resolve those fundamental anxieties if they are truly willing to work on themselves.

Positional Traders Trend Change Level is 17120 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 17048 will act as a Intraday Trend Change Level.