Intraday time for reversal can be at 9:44/10:24/11:41/12:17/1:21/2:26 How to Find and Trade Intraday Reversal Times

Multiple Events Today : 1. RBI Policy 2. Putin Speech 3. FTSE Rebalancing 4. Weekly/Monthly/Quarterly/Half Yearly closing so be cautious and vigilant in trading today.

Bank Nifty Oct Future Open Interest Volume is at 21.9 lakh with addition of 6.37 Lakh contract , with increase in Cost of Carry suggesting long positions were added today.

Bank NIfty Rollover cost @ 38460 and Rollover is at 76.5 %.

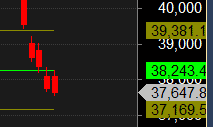

As per Musical Octave 38243 is Pivot Above it rally towards 39381 Below it 37169

Maximum Call open interest of 18 lakh contracts was seen at 37800 strike, which will act as a crucial resistance level and Maximum PUT open interest of 12 lakh contracts was seen at 37000 strike, which will act as a crucial Support level

MAX Pain is at 37500 and PCR @0.80 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

The pain of being wrong seems to increase exponentially in relation to the size of the position. If we normally trade one lots and now we are trading twos, the degree of difficulty in acting quickly when we are wrong is not twice but perhaps five times as great. Herein lies the magic that seems to cast its spell on each traderís psyche. The pain to our ego is in proportion to the size of trades. Avoidance of pain is what keeps us from acting fast. Losing that fear is the key to success. We must trust the process.

For Positional Traders Trend Change Level is 37835 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 37835 will act as a Intraday Trend Change Level.