As Discussed in Last Analysis We might open gap down tommrow tracking global cues but trend remains up till we are holding 40500. Bears will have chance below 40477 for a move towards 40240/40050/39852.Tommrow we have important Bayers Rule “Bayer Rule 2: Trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes. Leads to Big Move ” and also Mercury Conjunct Saturn HELIO suggesting first 15 mins High and low will guide for the day.

Astro Worked again as discussed on Twitter first 15 mins High was broken and trend for the day was on upside. Bank Nifty has given the highest daily close today which is a bullish sign, staying with the trend is diffcult as our Monkey Mind will keep searching some reason to Short as its has risen so much but my years of experience says stay with trend and ride till it bends.

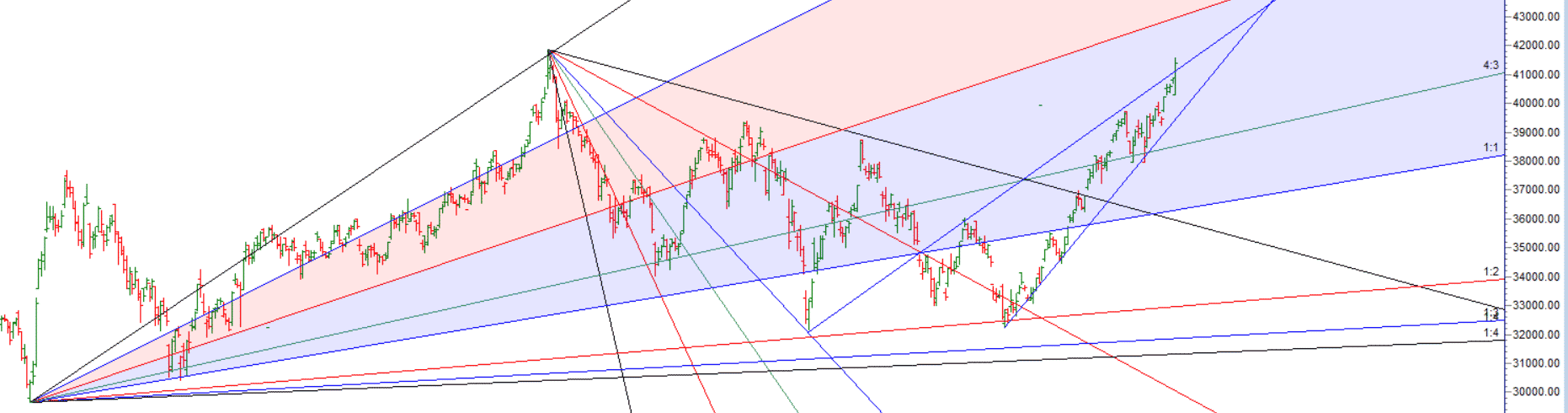

For Swing Traders Bulls need to move above 41493 for a move towards 41694/41894/42008. Bears will get active below 41292 for a move towards 41091/40891/40690.

Intraday time for reversal can be at 9:29/10:15/11:55/12:42/1:24/2/2:31 How to Find and Trade Intraday Reversal Times

Bank Nifty rollover cost @ 38918 and Rollover @73.2 % Closed above the rollover level suggesting bias is Bearish.

Bank Nifty Sep Future Open Interest Volume is at 22.5 lakh with addition of 1.2 Lakh contract , with increase in Cost of Carry suggesting long positions were added today.

As per Musical Octave 40518 is Pivot Above it rally towards 41724 Below it 39381 .

Maximum Call open interest of 58 lakh contracts was seen at 42000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 81 lakh contracts was seen at 40500 strike, which will act as a crucial Support level

MAX Pain is at 40700 and PCR @1.01 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Print out your trades.

- Were you disciplined?

- Did you execute on your stops?

- Did you do worse in a stock than you thought?

- Are you trading some stocks better than others?

- Are there some stocks that you just don’t trade well?

- Get into the habit of evaluating your more important trades during the day.

For Positional Traders Trend Change Level is 39879 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 41173 will act as a Intraday Trend Change Level.

Sur I am an avid follower of your extremely effective posts and try and learn from your techniques. You have ably captured Gann philosophy, coupled with strong understanding of astrology few of us can even aspire.

Thank you so much for the much needed guidance and gentle nudging in this very fascinating field.