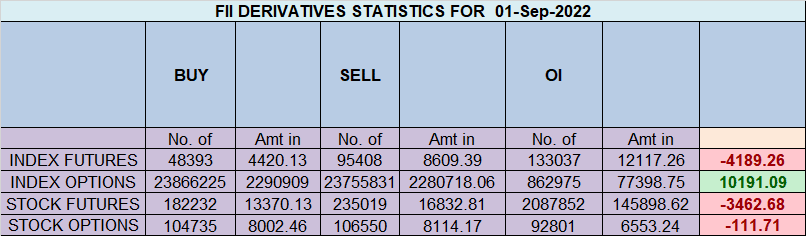

FII sold 47 K contract of Index Future worth 4189 cores, Net OI has increased by 33.8 K contract 6.6 K Long contract were covered by FII and 40.4 K Shorts were added by FII. Net FII Long Short ratio at 0.37 so FII used fall to exit long and enter short in Index Futures.

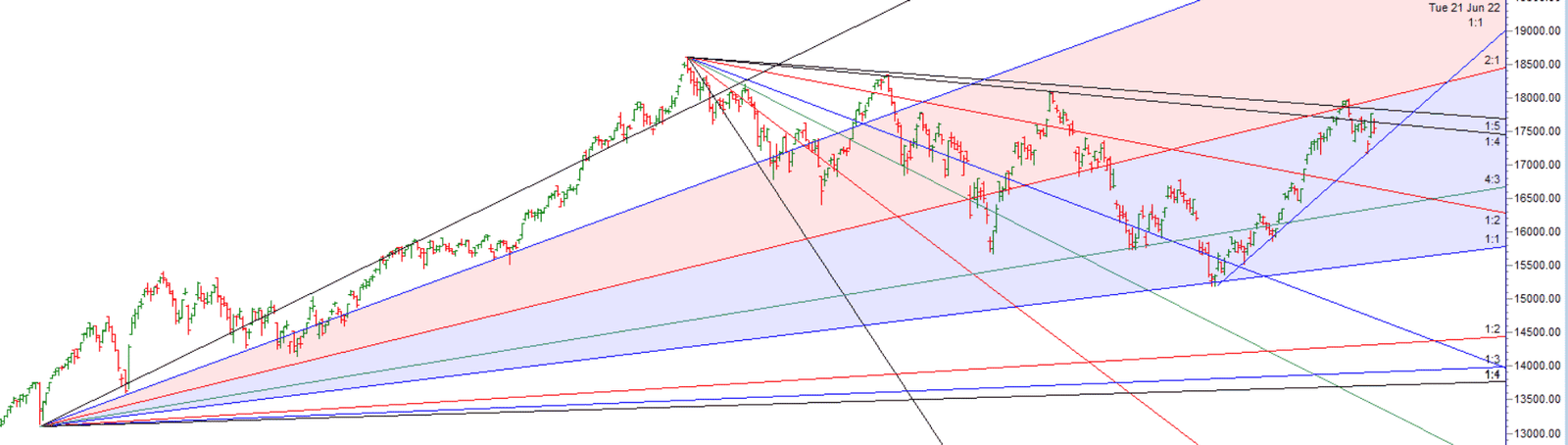

As Discussed in Last Analysis Today again we will see gap down of 275-300 points,Swing Trade Plan is Bullish above 17511 for a move towards17577/17644/17711, Bears will get active below 17377 for a move towards 17311/17244. Bulls were able to 3 target on upside , ON 04 Sep Bayer Rule 7: There are changes on market when Venus or Mars goes over its Aphelium Perihelium (Geocentric). will come in effect, so we can see another volatile move tommrow and can see good trend move next week. Swing Trade Plan is Bullish above 17562 for a move towards 17629/17695, Bears will get active below 17496 for a move towards 17429/17363/17296

Intraday time for reversal can be at 09:33/10:58/11:28/12:45/1:34/2:20 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17500 PCR at 0.81 PCR below 0.85 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 25 lakh contracts was seen at 17700 strike, which will act as a crucial resistance level and Maximum PUT open interest of 25 lakh contracts was seen at 17300 strike, which will act as a crucial Support level

Nifty Sep Future Open Interest Volume is at 1.16 Cores with addition of 5.3 Lakh with increase in cost of carry suggesting Long positions were added today.

Nifty rollover cost @ 17655 and Rollover @76.6 % Closed above the rollover level suggesting bias is Bullish

FII’s sold 2290 cores and DII’s bought 951 cores in cash segment.INR closed at 79.79

#NIFTY50 READY for another 500 points move in next 4 trading session as per musical octave 18058- 17551-17044 take the side and ride the move !!