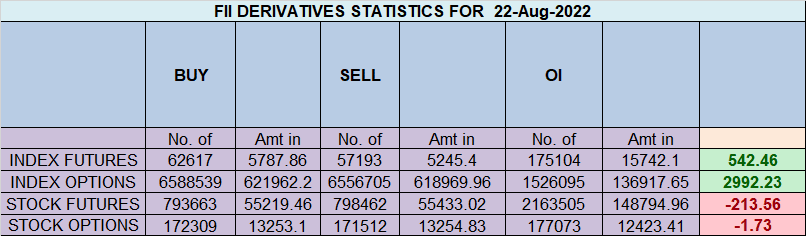

FII bought 5.4 K contract of Index Future worth 542 cores, Net OI has decreased by 18.1 K contract 6.3 K Long contract were covered by FII and 11.7 K Shorts were covered by FII. Net FII Long Short ratio at 0.99 so FII used fall to exit long and exit short in Index Futures.

We saw the impact of Gann Rule If a price is rising for 9 consecutive day’s at a stretch, then there is a high probability of a correction for 5 consecutive days. (Ratio is 9:5) and Double Ingress of Mars and Sun as per Astrology Bank NIfty saw 512 points correction in just 2 trading sessions. Now we have another important Rule kicking in today In a highly up trending market weekly low is achieved on Tuesday.

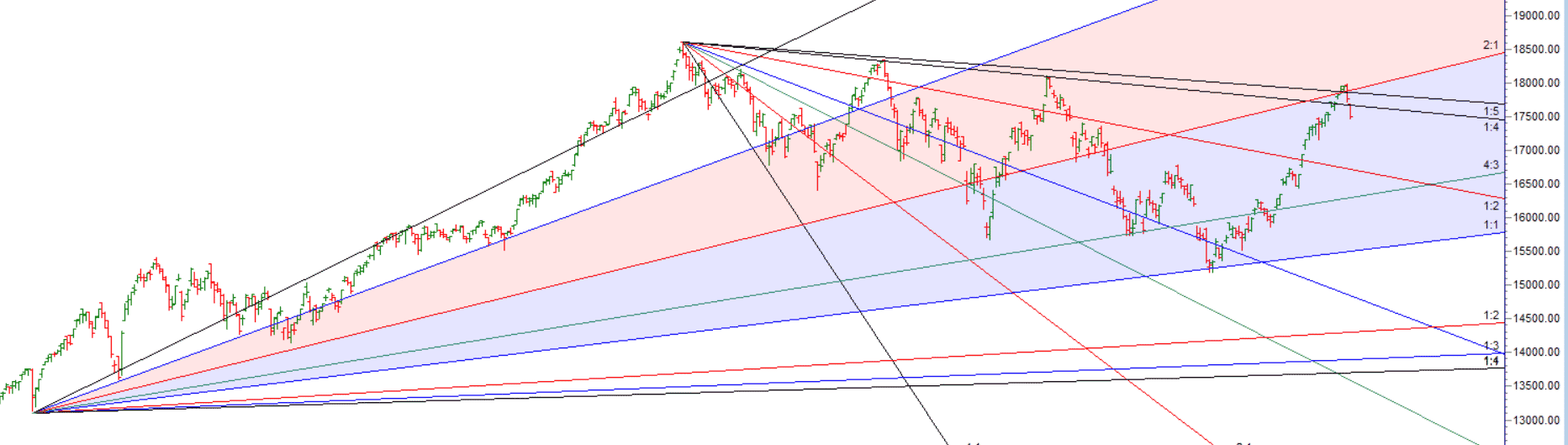

If this rule have to Kick in Bottom can be made today around 9:47-10:10 can bounce can be fast and furious. 17444-17459 level to be watched where 1 gann cycle is completing. For Swing Traders Bulls need to move above 17490 for a move towards 17557/17623/17690 Bears will get active below 17424 for move towards 17357/17291/17224.

Intraday time for reversal can be at 9:31/11:35/12:09/1/2:36 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17750 PCR at 0.93 PCR below 0.87 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 21 lakh contracts was seen at 17800 strike, which will act as a crucial resistance level and Maximum PUT open interest of 18 lakh contracts was seen at 17300 strike, which will act as a crucial Support level

Nifty Sep Future Open Interest Volume is at 0.44 Cores with addition of 0.75 Lakh with increase in cost of carry suggesting Long positions were added today.

Nifty rollover cost @ 16670 and Rollover @67.7 % Closed above the rollover level suggesting bias is Bullish

FII bought 43.6 K CE and 39.1 K CE were shorted by them and FII bought 48.3 K PE and 21 K PE were shorted by them suggesting they are Neutral bias, Net FII have Bought 2992 Cores worth of OPtions SUggesting we can continue seeing trending move.

Retailers bought 608 K CE and 492 K CE were shorted by them. Retailers bought 158 K PE and 142 K PE were shorted by them suggesting they are Bullish bias

FII’s sold 53 cores and DII’s sold 85 cores in cash segment.INR closed at 79.85

#NIFTY50 READY for another 500 points move in next 4 trading session as per musical octave 18058- 17551-17044 take the side and ride the move !!

Your Trade was on DOT today. You expected a Tuesday Low or the time which you have given. Nifty had a big gap down and flew 280 points opening Low. On the other hand what happened to the Gann Rule on 5 Continuous day fall. Is that Invalid now . Please confirm Sir