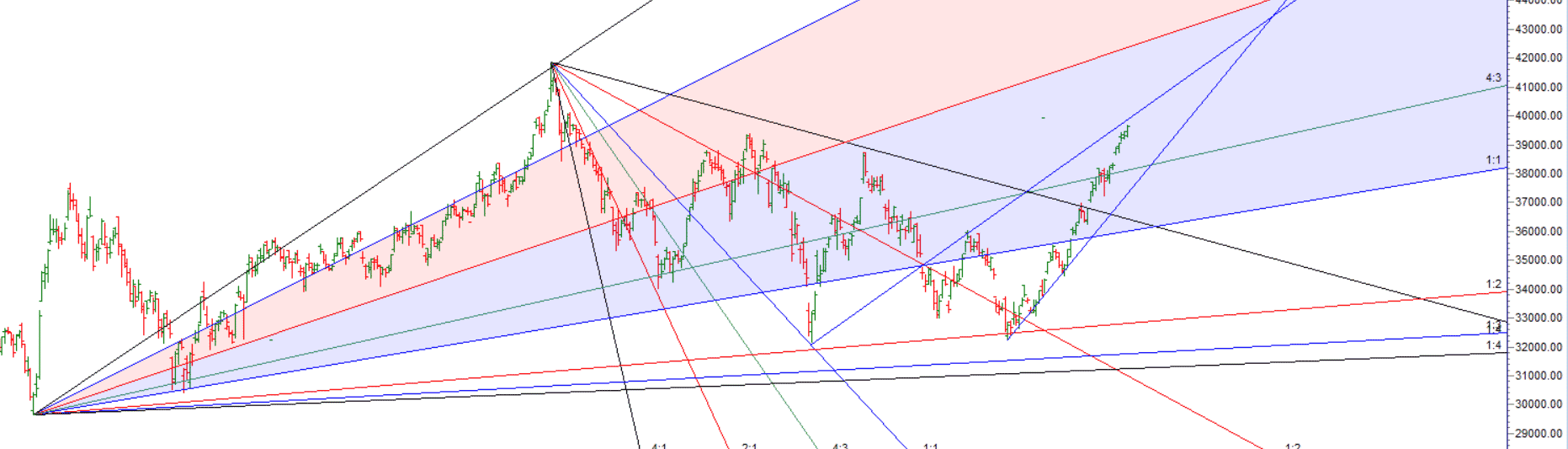

As Discussed in Last Analysis Bank Nifty has seen one of the Biggest Rally of 2022 with Index rising Non Stop from 34463 till 39504 almost a 5000 points rally in just 22 trading sessions.Tommrow Venus Trine Jupiter its important from gold and stocks specially banks. 39304-39381 is important zone Shorts should be taken below 39304 on 15 mins candel sustained. For Swing Traders Bulls need to move above 39515 for a move towards 39713/39911/40108. Bears will get active below 39300 for move towards 39107/38908. We have Mars and Sun Ingress double ingress on Weekend so be cautious as it can lead to trend change and it will happen fast. Bulls are waiting for 39713/39911/40108 till close above 39515 . Bears will get active below 39400 for move towards 39202/38908.

Intraday time for reversal can be at 9:15/11:35/12:57/1:05/2:14 How to Find and Trade Intraday Reversal Times

Bank Nifty Aug Future Open Interest Volume is at 26 lakh with liquidation of 2.7 Lakh contract , with increase in Cost of Carry suggesting Long positions were closed today.

Its Basic Human Nature, Markets are up Traders want to Short Market are down traders want to Buy and this particular Emotions are exploited by Smart Money and Current Rally is classic Example,Many traders are losing on their shorts and market keep going up everyday.

As per Musical Octave 39381 is Pivot Above it rally towards 40518 Below it 38243.

Maximum Call open interest of 14 lakh contracts was seen at 39800 strike, which will act as a crucial resistance level and Maximum PUT open interest of 11 lakh contracts was seen at 39000 strike, which will act as a crucial Support level

MAX Pain is at 39500 and PCR @0.93 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.3

Its all Right , Eventually I will get a Winner, Do not lose inordinate amount of the money.