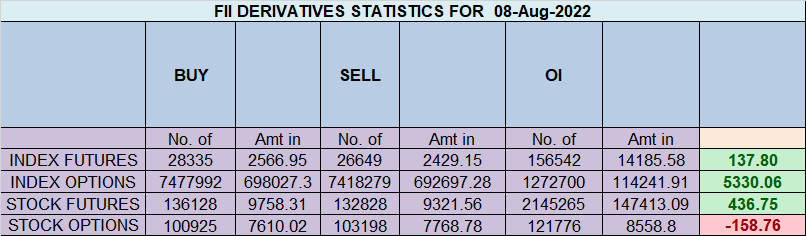

FII bought 1.6 K contract of Index Future worth 137 cores, Net OI has increased by 10.8 K contract 6.2 K Long contract were added by FII and 4.5 K Shorts were added by FII. Net FII Long Short ratio at 1.23 so FII used rise to enter long and enter short in Index Futures.

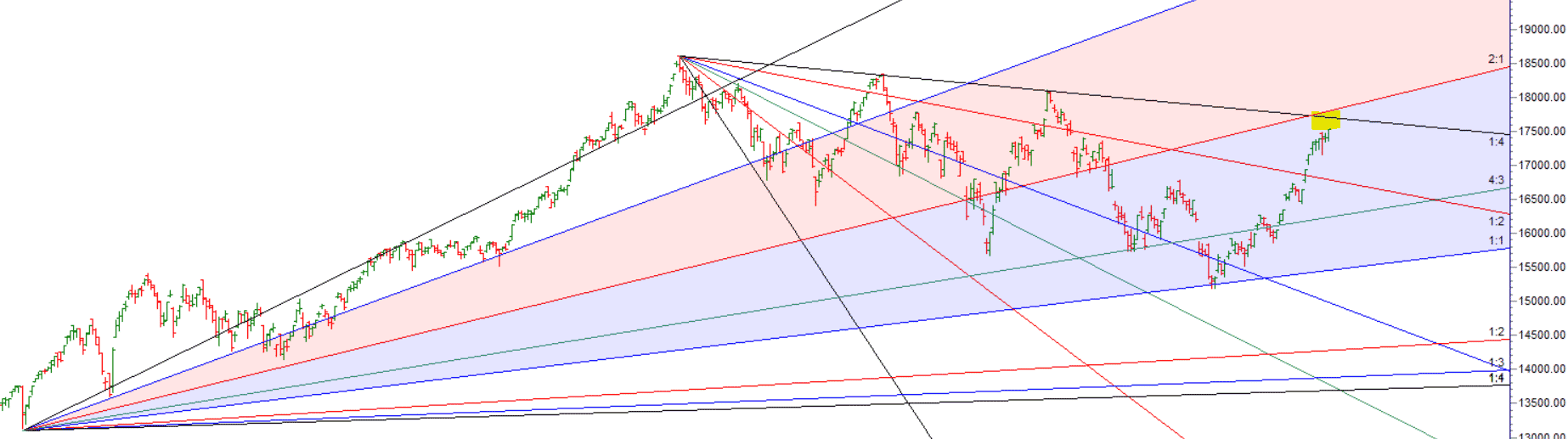

We are into relent less Buying and 500 points up on NF in the week. In the last 5 trading days, FII have to add 6123 crore worth of equity buying to that – it shows that FII are adding money big time in the Indian Markets.Now we are near important zone of 17555-17576 which will again lead to 555 poits move in Nifty, For Swing Traders BUlls will get active above 17576 for a move towards 17623/17689/17755. Bears will get active below 17425 for a move towards 17359/17285/17222. We have SUN Square North Node aspect so we can see voaltile move in Nifty.

Intraday time for reversal can be at 9:15/09:52/11:31/12:22/1:04/2:04 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17600 PCR at 0.91 PCR below 0.87 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty Aug Future Open Interest Volume is at 1.08 Cores with addition of 0.78 Lakh with increase in cost of carry suggesting Long positions were added today.

Nifty rollover cost @ 16670 and Rollover @67.7 % Closed above the rollover level suggesting bias is Bullish

Jupiter Retrograde will end of 23 Novemeber so High 16947 and Low of 16746 will be valid till 23 November, Break of ANy side will lead to minimum 555 points move. — 555 Done

Retailers have bought 134 K CE contracts and 188 K CE contracts were shorted by them on Put Side Retailers bought 940 K PE contracts and 767 K PE shorted contracts were added by them suggesting having BEARISH outlook,On Flip Side FII bought 66 K CE contracts and 8.4 K CE were shorted by them, On Put side FII’s bought 74.7 K PE and 68.8 K PE were shorted by them suggesting they have a turned to neutral Bias.

FII’s bought 1449 cores and DII’s sold 140 cores in cash segment.INR closed at 79.74

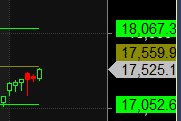

#NIFTY50 READY for another 500 points move in next 4 trading session as per musical octave 16108-16573-17066 take the side and ride the move !! — 17559 done now waiting for 18067.