FII bought 19.3 K contract of Index Future worth 1642 cores, Net OI has increased by 34.3 K contract 26.8 K Long contract were added by FII and 7.5 K Shorts were added by FII. Net FII Long Short ratio at 0.82 so FII used fall to exit long and enter short in Index Futures.

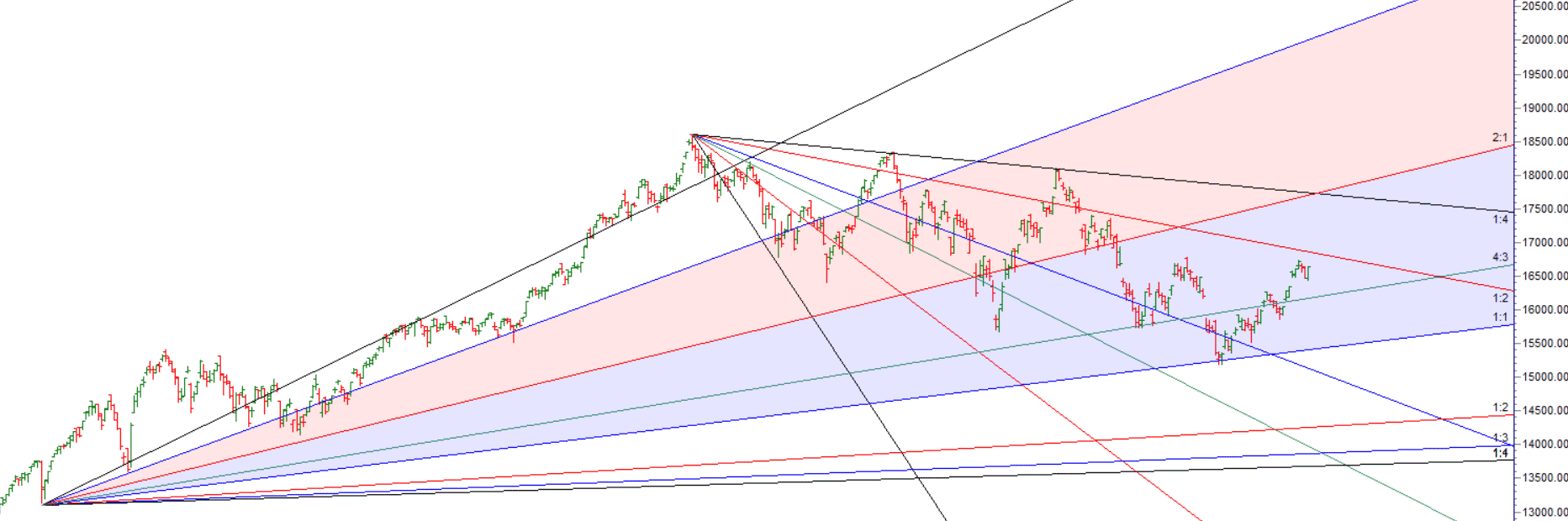

As Discussed in Last Analysis 16483 done and we have formed an evening star pattern For Swing traders bulls need a move above 16535 for a move towards 16610/16666.Bears will get active below 16434 for a move towards 16385/16323. Low made was 16438 so bears unable to break 16434 and bulls once above 16535 did 16610 and now waiting for 16666. For Swing traders bulls need a move above 16695 for a move towards 16759/16823/16887.Bears will get active below 16567 for a move towards 16502/16438. We have JUpiter Retrograde tommrow so first 15 mins high and low will guide us and also formed Outside Bar pattern suggesting today low is not breached we are heading towards 17000.

Intraday time for reversal can be at 9:47/10:54/12:26/1:31/2:45 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16600 PCR at 0.91 PCR below 0.87 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty Aug Future Open Interest Volume is at 0.59 Cores with addition of 9.2 Lakh with increase in cost of carry suggesting Long positions were added today.

We are living in an insane world – Fed confirm intrest rate hike of 75/100 BPS – And we rally on Bad news. So, dont be surprised if markets appear irrational.

Retailers have sold 213 K CE contracts and 10 K CE contracts were shorted by them on Put Side Retailers sold 874 K PE contracts and 657 K PE shorted contracts were covered by them suggesting having BEARISH outlook,On Flip Side FII bought 59.8 K CE contracts and 4.1 K CE were shorted by them, On Put side FII’s bought 71.4 K PE and 101 PE were shorted by them suggesting they have a turned to BULLISH Bias.

Maximum Call open interest of 69 lakh contracts was seen at 16800 strike, which will act as a crucial resistance level and Maximum PUT open interest of 51 lakh contracts was seen at 16500 strike, which will act as a crucial Support level. There is total OI of 13.2 Cr on the Call side and 23.2 Cr on the Put side. So, the activity is more on PUT side indicating Option Writers are having BULLISH Bias.

FII’s sold 436 cores and DII’s bought 712 cores in cash segment.INR closed at 77.90

#NIFTY50 READY for another 500 points move in next 4 trading session as per musical octave 16108-16573-17066 take the side and ride the move !!