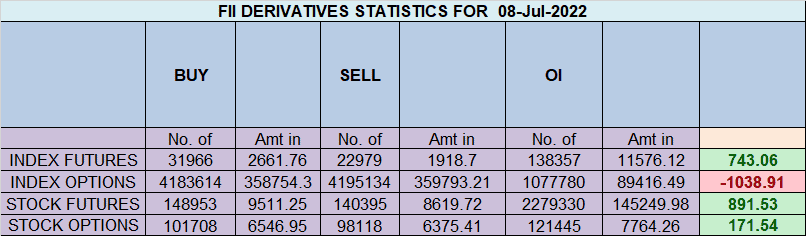

FII bought 8.9 K contract of Index Future worth 743 cores, Net OI has decreased by 8 K contract 466 Long contract were added by FII and 8.5 K Shorts were covered by FII. Net FII Long Short ratio at 0.37 so FII used rise to enter long and exit short in Index Futures.

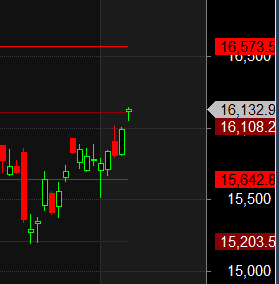

As Discussed in Last Analysis We are up 400 points once Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes high of 15852 thats how astro works .Bulls were able to close above 16115 now waiting for target of 16178/16240/16303. Bears will get active below 16098 for a move towards 16005/15954. 2 target done and we have seen side ways move as next important astro date is on 12-13 July so monday can be also sideways day. Bulls were able to close above 16236 now waiting for target of 16299/16362/16426. Bears will get active below 16172 for a move towards 16108/16046.

Intraday time for reversal can be at 9:28/10:33/11:48/12:09/1:48/2:50 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16200 PCR at 0.97 PCR below 0.87 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty July Future Open Interest Volume is at 1.08 Cores with liqudidation of 6.9 Lakh with decrease in cost of carry suggesting Long positions were closed today.

Nifty rollover cost @ 15801 and Rollover @66.1 % Closed above the rollover level suggesting bias is Bullish

Maximum Call open interest of 34 lakh contracts was seen at 16300 strike, which will act as a crucial resistance level and Maximum PUT open interest of 34 lakh contracts was seen at 16000 strike, which will act as a crucial Support level. There is total OI of 6.2 Cr on the Call side and 7.2 Cr on the Put side. So, the activity is more on PUT side indicating Option Writers are having BULLISH Bias.

FII’s sold 109 cores and DII’s bought 34 cores in cash segment.INR closed at 79.40

Retail Traders Lose Money By Looking For A Trending Move In Non-trending Environments And Staying Out In Trending Environments.

As per Musical Octave Above 15642 Rally towards 16108. 16108 done now till we are holding 16108 rally towards 16573

If your goal is to become an elite trader, then your time is a very valuable commodity. It is the most important commodity that you have. Use it wisely. Act in your self interest. Be focused on all things becoming a better trader.

For Positional Traders Stay long till we are holding Trend Change Level 15902 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 16205 will act as a Intraday Trend Change Level.

If a trader is confused about what he is doing, the probable win ratio is zero and he might as well give up trading.

Hello… What is the best way to connect on personal basis. Need to discuss professional trading

shared with u training details