FII sold 8.7 K contract of Index Future worth 735 cores, Net OI has increased by 1.8 K contract 3.4 K Long contract were covered by FII and 5.3 K Shorts were added by FII. Net FII Long Short ratio at 0.37 so FII used fall to exit long and enter short in Index Futures.

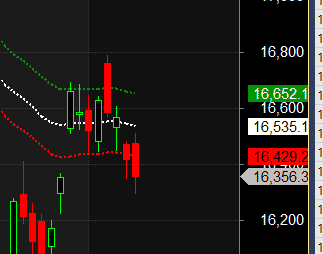

As Discussed in Last Analysis Nifty opened with gap down and closed below Saturn Retrograde low. We are near the gann angle support and also today was 90 day from 08 March suggesting price time are meeting and we can see strong reversal if we close above 16469 tommrow. For Swing Traders Bulls need to move above 16469 for a move towards 16534/16599/16666. Bears will get active below 16340 for a move towards 16275/16212/16166/16108. Another day rally came but price unable to touch Saturn Retrograde high and below 16444 Saturn retrogrde low again saw a decent fall.Both Bulls and Bears were unable to do 1 target on upside and downside and Levels shared on Intraday worked perfectly. Tommrow we can see big move as NIfty has formed an Outside bar Pattern today and price is near gann angle support zone as shown below. For Swing Traders Bulls need to move above 16405 for a move towards 16469/16534/16599. Bears will get active below 16340 for a move towards 16275/16212/16166/16108.

RBI Policy outcome will come after 10:30 AM. Once the RBI Governor Stop speaking take position after that only, Till 10:39 AM we can see wild swings. Saturn is in Retrograde in Aquarius.Interest rates will go up for sure but it remains to be seen by how much.Any hike or any comment which indicates more than anticipated rate might dampen the mood further and could keep our markets in corrective mode. So just keep an eye your postions especially in F & O. However dip should be used to buy as the markets could bounce sharply as Moon goes Declination on 10 June.

Intraday time for reversal can be at 10:12/11:10/12:36/1:13/2:06 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16400 PCR at 0.85 PCR below 0.89 and above 1.3 lead to trending moves, and in between leads to range bound markets.Nifty rollover cost @ 16139and Rollover @69.6 %.

Nifty May Future Open Interest Volume is at 1.12 Cores with addition of 1.3 Lakh with increase in cost of carry suggesting SHORT positions were added today. Today we have seen Highest Volume in NF for this series.

Maximum Call open interest of 68 lakh contracts was seen at 16400 strike, which will act as a crucial resistance level and Maximum PUT open interest of 61 lakh contracts was seen at 16200 strike, which will act as a crucial Support level

FII’s sold 2484 cores and DII’s bought 1904 cores in cash segment.INR closed at 77.81

To outperform the market and to succeed in trading, a trader needs to take charge of his emotions.To start off, he requires a patient and confident mind.

For Positional Traders Stay long till we are holding Trend Change Level 16473 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 16418 will act as a Intraday Trend Change Level.