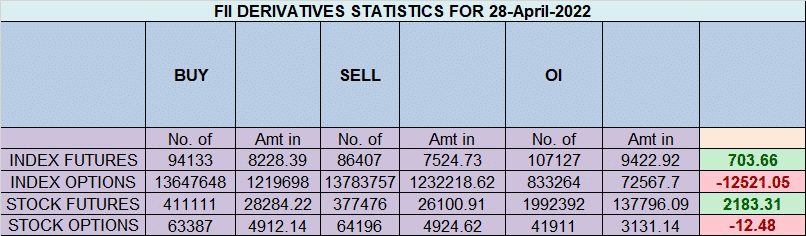

FII bought 7.7 K contract of Index Future worth 703 cores, Net OI has decreased by 71.1 K contract 21.4 K Long contract were covered by FII and 49.7 K Shorts were covered by FII. Net FII Long Short ratio at 0.53 so FII used fall to exit long and exit short in Index Futures.

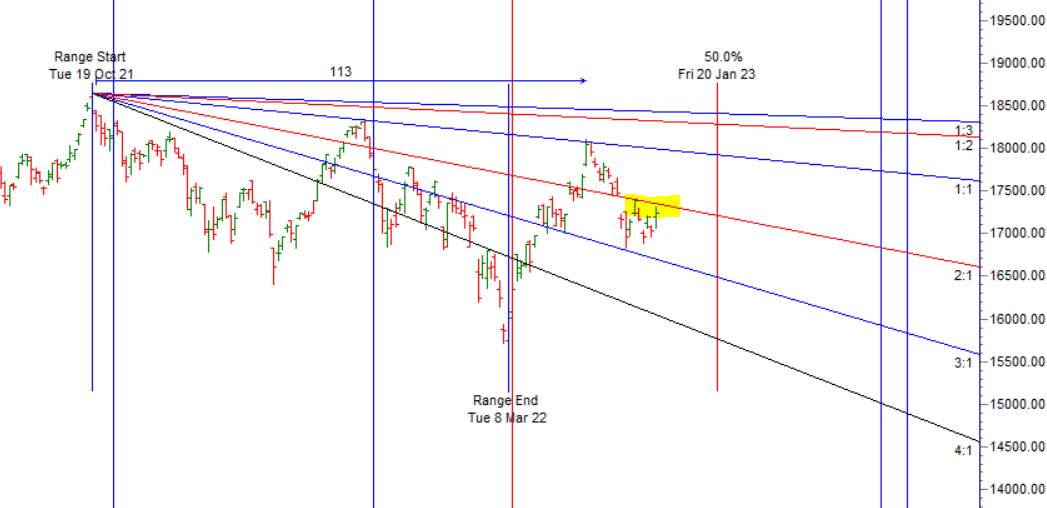

As Discussed in Last Analysis Price is back to middle of angle support and we have two important astro dates tommrow as shown in below video so we can see explosive expiry. Bulls need to move above 17084 for a move towards 17149/17213/17278. Bears will get active below 17019 for a move towards 16954/16889/16824. Astro Dates worked perfectly and we got explosive expiry, We have Pluto Retrograde and Mercury Ingress tommrow so we can see another big move tommorow. Bulls need to move above 17332 for a move towards 17397/17469/17528. Bears will get active below 17201 for a move towards 17136/17071

Intraday time for reversal can be at 9:54/10:44/1:00/1:51/2:48 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17100 PCR at 0.91 , Rollover cost @17121 closed below it and rollover @65.6 lowest in 3 months. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty May Future Open Interest Volume is at 0.85 Cores with addition of 21.8 Lakh with increase in cost of carry suggesting LONG positions were added today.

The Option Table data indicates decent support at 17100 and reasonable resistance at 17500 . There is total OI of 3.2 Cores on the Call side and 4.8 Cores on the Put side, So, the activity is more on the PUT side, indicating option writers are in BULLISH zone.

FII’s bought 743 cores and DII’s bought 780 cores in cash segment.INR closed at 76.50

25 April was Moon and Saturn Aspect ,High of 17054 and 16888 is valid for whole weeek Mark in on your charts and take trade on break of High and Low. — Got Big move today

Watch for 17261 for a move towards 17469.

Athletes Commonly Review Tapes Of Their Performances; Chess Players Review Their Games; Professional Models Watch Themselves On Screen To Refine Their Presentation; Military Commanders Lead After-action Reviews Following Missions. Everywhere We See Elite Performance, We See Performers Reviewing Their Work As Part Of Ongoing Learning. The Collection Of Metrics Can Serve A Similar Function For Traders.

For Positional Traders Stay long till we are holding Trend Change Level 17340 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17224 will act as a Intraday Trend Change Level.