FII bought 15.9 K contract of Index Future worth 1441 cores, Net OI has increased by 1.8 K contract 8.9 K Long contract were added by FII and 7 K Shorts were covered by FII. Net FII Long Short ratio at 3.1 so FII used rise to enter long and exit short in Index Futures.

As Discussed in Last Analysis We have Sun Conjunct Mercury Aspect happening on Weekend it leads to turing point in market. Astro worked perfectly as we got a very good turning point in the market. Now todat we have Mars Saturn Aspect which is again very important for turning point as explained in below video. In the biggest merger in Indian corporate history, the boards of HDFC and HDFC Bank on Monday cleared a $40 billion amalgamation of the parent housing finance company with its banking arm. Now Bulls need to move above 18125 for a move towards 18191/18258/18324. Bears will have chance below 18058 for a move towards 17991/17924/17858.

Intraday time for reversal can be at 9:15/10:34/11:16/12:46/1:37/2:25 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17850 PCR at 0.88 , Rollover cost @17418 closed above it. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty April Future Open Interest Volume is at 1.11 Cores with liquidation of 7 Lakh with increase in cost of carry suggesting LONG positions were closed today.

The Option Table data indicates decent support at 17900 and reasonable resistance at 18300 . There is total OI of 3.66 Cores on the Call side and6.85 Cores on the Put side, So, the activity is more on the PUT side, indicating option writers are in BULLISH zone.

FII’s bought 1152 cores and DII’s bought 1675 cores in cash segment.INR closed at 75.73.

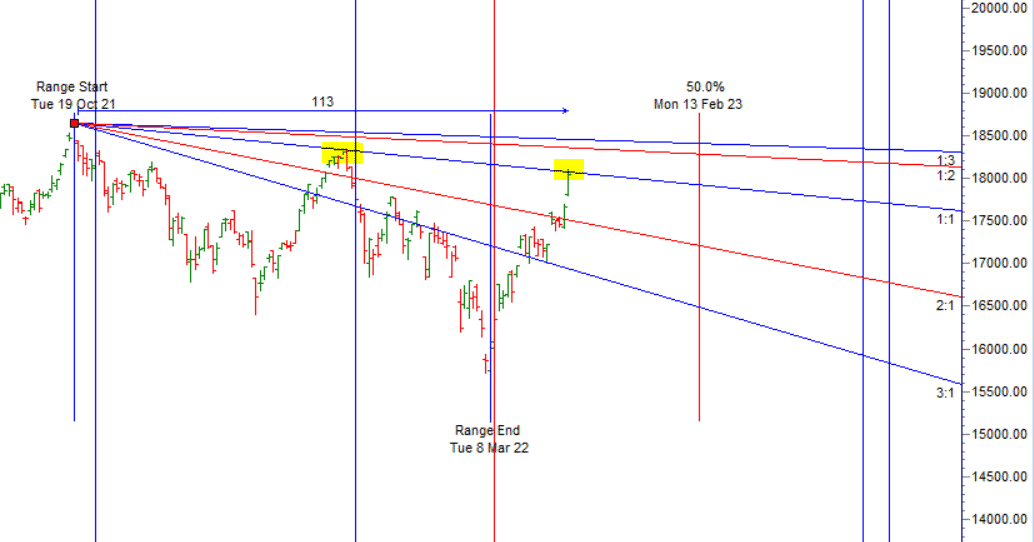

17828 important trend change level for nifty for April. ABove and below it we can see 300+ points move. — 300+ Points done above 17828

Retailers have bought 460 K CE contracts and 322 K CE contracts were shorted by them on Put Side Retailers bought 802 K PE contracts and 599 K PE shorted contracts were added by them suggesting having NEUTRAL outlook,On Flip Side FII bought 96.6 K CE contracts and 69.4 K CE were shorted by them, On Put side FII’s bought 102 K PE and 96.6 K PE were shorted by them suggesting they have a turned to BULLISH Bias.

Ego will avoid the pain associated with losing. Strange messages are sent to your brain on behalf of the ego’s position. These little memos from your ego will encourage you to take profits quickly, double up on a bad position, let your losses run, and trade bigger than you should. Control EGO to be profitable in market.

For Positional Traders Stay long till we are holding Trend Change Level 17807 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 18011 will act as a Intraday Trend Change Level.

Hello SIr Intraday Nifty Levels r not updated

Thanks sir