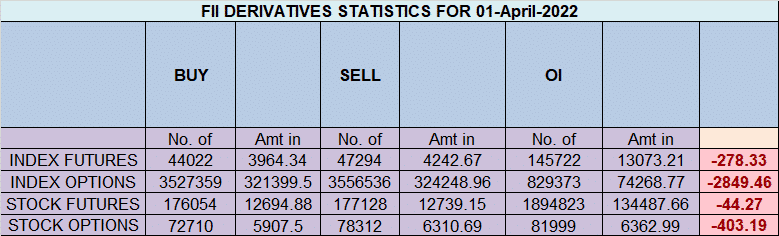

FII sold 3.2 K contract of Index Future worth 278 cores, Net OI has increased by 9.3 K contract 3 K Long contract were added by FII and 6.3 K Shorts were added by FII. Net FII Long Short ratio at 2.44 so FII used rise to enter long and enter short in Index Futures.

As Discussed in Last Analysis Its been 2 days of sideways move so we can expect range expansion today as we have NEW MOON today and multiple astro events in weekend. Price has also teacted from trendline resistance as show below in Supply Demand Chart. Plan remains the same, Any close above 17507 can lead to rally towards 17576/17666. Bears will have chance below 17405 for a move towards 17323/17275. First 15 mins HIgh and low will decide the trend of the day, Low maded was 17422 so bears unable to break 17405 and bulls once above 17507 did all target on upside so patience of last 2 days rewarded. Astro cycle played its role as once above 15 mins High bulls were in control. Now Bulls need to move above 17714 for a move towards 17775/17828. We have Sun Conjunct Mercury Aspect happening on Weekend it leads to turing point in market.

I have discuused few of gann learning in below video,watch for some nice insights.

Intraday time for reversal can be at 9:41/11:19/12:42/1:41/2:29 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17500 PCR at 0.89 , Rollover cost @17418 closed above it. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty April Future Open Interest Volume is at 1.19 Cores with liquidation of 3.6 Lakh with increase in cost of carry suggesting LONG positions were closed today.

The Option Table data indicates decent support at 17500 and reasonable resistance at 17800. There is total OI of 3.66 Cores on the Call side and 4.85 Cores on the Put side, So, the activity is more on the PUT side, indicating option writers are in BULLISH zone.

FII’s bought 1909 cores and DII’s sold 183 cores in cash segment.INR closed at 75.98.

17828 important trend change level for nifty for April. ABove and below it we can see 300+ points move.

Retailers have bought 308 K CE contracts and 369 K CE contracts were shorted by them on Put Side Retailers bought 774 K PE contracts and 702 K PE shorted contracts were added by them suggesting having NEUTRAL outlook,On Flip Side FII bought 21.1 K CE contracts and 17.4 K CE were shorted by them, On Put side FII’s bought 33.5 K PE and 66.3 K PE were shorted by them suggesting they have a turned to BULLISH Bias.

Ego will avoid the pain associated with losing. Strange messages are sent to your brain on behalf of the ego’s position. These little memos from your ego will encourage you to take profits quickly, double up on a bad position, let your losses run, and trade bigger than you should. Control EGO to be profitable in market.

For Positional Traders Stay long till we are holding Trend Change Level 17579 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17603 will act as a Intraday Trend Change Level.

hello Bramesh sir please Correct Intraday Buy Level Sir You give (Buy Above 17475 Tgt 17500, 17525 and 17555) Is it right ??