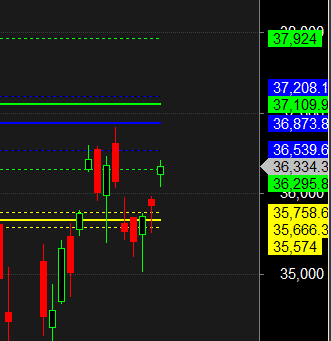

As Discussed in Last Analysis We will open gap up tommrow as Bayers Rules worked perfectly. Any close above 36000 can lead to rally towards 36300/36539. Bears will have chance below 35758 for a move towards 35666/35574. Low made was 36070 bulls were able to do 36300 now waiting for 36539. Above 36539 next target are 36873/37109. Bears will get active below 35999 for a move towards 35758/35666.

Intraday time for reversal can be at 9:28/11:31/12:03/1:57/2:47 How to Find and Trade Intraday Reversal Times

Bank Nifty March Future Open Interest Volume is at 13.1 lakh with liquidation of 3.1 Lakh contract , with increase in Cost of Carry suggesting SHORT positions were closed today.

The option table data indicates decent support at 36000 and reasonable resistance at 36800.

The Option Table data indicates decent support at 36000 and reasonable resistance at 36800. There is total OI of 2.40 Cores on the Call side and 2.57 Cores on the Put side, So, the activity is more on the PUT side, indicating option writers are in BULLISH zone.

MAX Pain is at 36200 and PCR @0.94 Rollover cost @37206 closed below it.

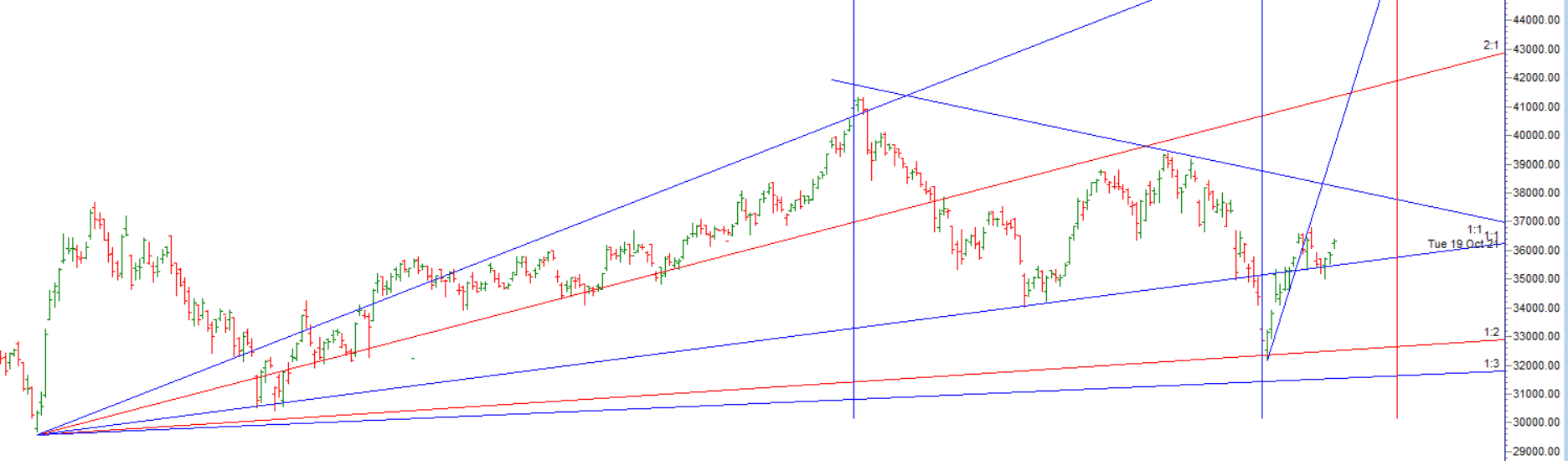

Bayer Rule 6: The price is in bottom when Mars was in 16 degrees 35 minutes of some sign and plus 30 degrees and Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes, Mercury moving in Aries and Mercury Conjunct Jupiter HELIO. These 4 Astro events are happening on 27 and 28 March suggesting it will be High Energy day and lead to big move in market. First 15 Mins High and Low on Monday will decide the trend for the whole week. — Worked Perfectly We are up 1500 points from Monday low.

35790 Bank Nfty watch out closely its important Gann TC level 500-600 pt up and down move will be seen. — Closed above 35790 and 500 points done

Never risk a large chunk of your capital on a single trade; Always know what the worst possible outcome is. The Opposite of above most of traders do and bust their trading account.

For Positional Traders Trend Change Level is 35308 on Futures and go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 36284 will act as a Intraday Trend Change Level.