FII bought 10.4 K contract of Index Future worth 901 cores, Net OI has decreased by 2 K contract 7.5 K Long contract were added by FII and 2.8 K Shorts were covered by FII. Net FII Long Short ratio at 1.38 so FII used rise to enter long and exit short in Index Futures.

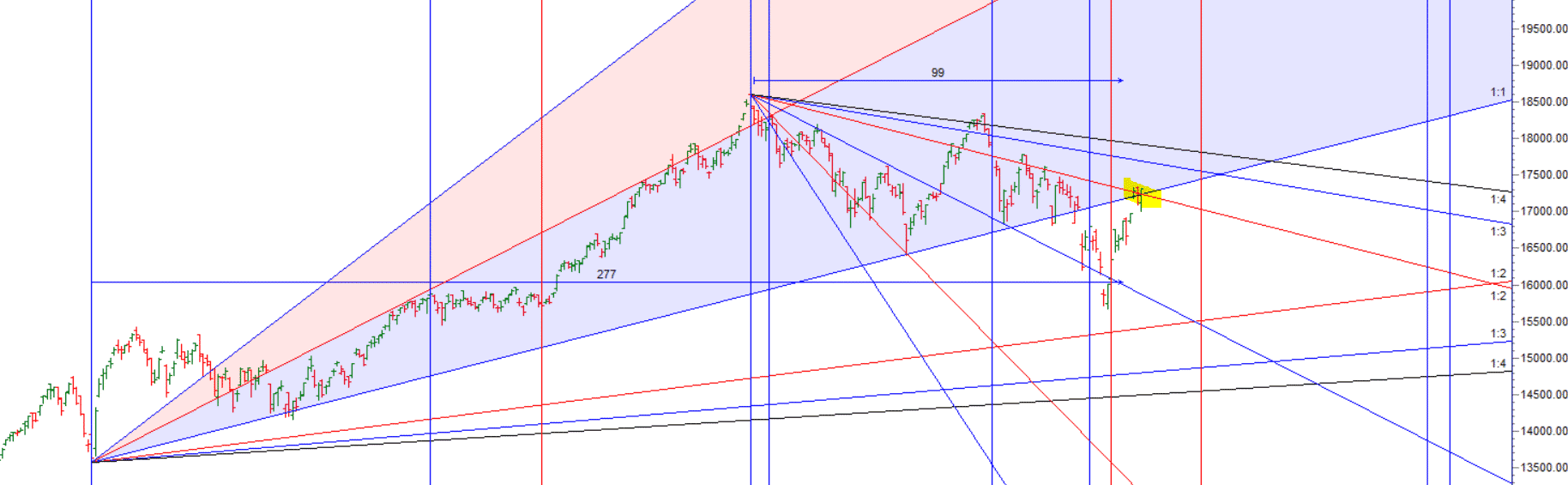

As Discussed in Last Analysis Now Bears need to move below 17089 for a move towards 17024/16958/16892. Bulls will get active above 17221 for a move towards 17287/17353. Almost all target done on upside. For Swing traders Bears need to move below 17267 for a move towards 17201/17136/17071. Bulls will get active above 17397 for a move towards 17462/17527.

Intraday time for reversal can be at 9:44/10:16/10:51/11:55/1:31/2:28 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17300 PCR at 0.74, Rollover cost @16997 closed above it. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty March Future Open Interest Volume is at 1.12 Cores with addition of 4.3 Lakh with increase in cost of carry suggesting LONG positions were added today.

The option table data indicates decent support at 17000 and reasonable resistance at 17500.

17011 is very important gann number which needs to be seen. We also have gap open between 16967-17096. Break of 17096 should lead to fall towards 17011-16967. —Low made 17006 and we saw a big move.

Do not get complacent with longs till we do not close above 17405-17456 zone, Basically range of 17405-17456 on upside and 16998-16930 on downside is strong supply and demand zone. Break of any side will lead to 400-500 points move.

FII’s bought 384 cores and DII’s sold 602 cores in cash segment.INR closed at 76.23

Even the equity buying is very minimal – FII buying just enough to produce the rally.

Retailers have sold 36.1 K CE contracts and 16.1 K CE contracts were shorted by them on Put Side Retailers bought 372 K PE contracts and 360 K PE contracts were shorted by them suggesting having BEARISH outlook,On Flip Side FII sold 23.3 K CE contracts and 9.1 K CE were shorted by them, On Put side FII’s bought 11.6 K PE and 12.8 K PE were shorted by them suggesting they are still having to BULLISH Bias

For Positional Traders Stay long till we are holding Trend Change Level 17250 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17216 will act as a Intraday Trend Change Level.