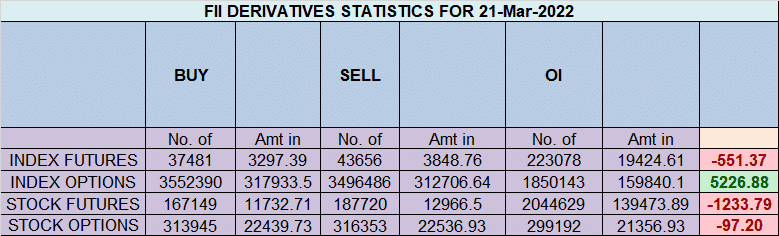

FII sold 6.1 K contract of Index Future worth 551 cores, Net OI has decreased by 2 K contract 4.1 K Long contract were covered by FII and 2 K Shorts were added by FII. Net FII Long Short ratio at 1.26 so FII used rise to exit long and enter short in Index Futures.

As Discussed in Last Analysis Now Bulls need to move above 17503 for a move back to 17568/17634/17700, Bears below 17437 for a move towards 17372/17306/17241. 21 March showed its impact as discussed in below video. Now Bears need to move below 17089 for a move towards 17024/16958/16892. Bulls will get active above 17221 for a move towards 17287/17353.

Intraday time for reversal can be at 9:28/10:13/11:58/1:35/2:32 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17200 PCR at 0.95, Rollover cost @16997 closed below it.

Nifty March Future Open Interest Volume is at 1.08 Cores with liquidation of 0.68 Lakh with increase in cost of carry suggesting LONG positions were closed today.

The option table data indicates decent support at 17000 and reasonable resistance at 17500.

17011 is very important gann number which needs to be seen. We also have gap open between 16967-17096. Break of 17096 should lead to fall towards 17011-16967.

Another Imp WD GAnn Rule A market that has been strong during the week or especially during the latter part of the week and closes strong on Friday,is likely to open strong Monday and finish the advance in the first hour on Monday.Therefore, be very careful about buying stocks on Monday moming’s strong opening. Public buying orders which accumulate over Sunday are all executed Monday moming and as soon as this demand is supplied professionals start selling and the market has a reaction in proportion to its condition and position at the time. So Monday 9:15-10:15 AM will decide the trend for the week. — Worked Perfectly.

W.D. Gann: “March 21st is 90 days from December 22nd. This is the date when the Sun crosses the equator and Spring begins. The Spring rally in the stock market often starts around this date or culminates if stocks have been advancing previous to this date.” — On 20 Dec we made bottom lets see what happens on 21 March. — Got a good Move.

FII’s sold 2962 cores and DII’s bought 252 cores in cash segment.INR closed at 76.17

Retailers have bought 120 K CE contracts and 106 K CE contracts were shorted by them on Put Side Retailers bought 349 K PE contracts and 433 K PE contracts were shorted by them suggesting having BULLISH outlook,On Flip Side FII bought 132 K CE contracts and 134 K CE were shorted by them, On Put side FII’s bought 82 K PE and 24 K PE were shorted by them suggesting they are still having to BEARISH Bias

For Positional Traders Stay long till we are holding Trend Change Level 17157 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17234 will act as a Intraday Trend Change Level.

Sir, i want to learn from you..

Where can i get courses/training please guide